In March of this year, Informa bought Tarsus for $940m. The 14 times EBITDA deal confirmed Informa as the world’s largest Live Events (LE) company with projected revenues of $3bn. It showed that the whole LE market continues to bounce back strongly out of the 2020 digital-only hibernation of the pandemic. Yet it was also a reminder of just how big and fragmented the global LE business actually is – Informa’s market share is still single digit. So, there must be a lot more M&A and consolidation activity still to come.

A complex marketplace

mediafutures shows that the whole LE market over the next two years is complex and challenging despite the opportunities. Essentially, topline revenue growth at an industry level is continuing, but is slowing down after the 2022 bounce-back boom.

The benchmarking programme picks up three distinct pools of activity:

- Consumer Media where LE accounts for a significant and growing 15% of total industry revenues, although this share growth is now slowing down.

- B2B, where the share is a much larger 53%, but this is well down on pre-pandemic levels and is still reducing as companies diversify into other areas.

- LE-only specialists, a sub-sector of B2B, who are currently reporting above average turnover growth (+16% YoY now, but slowing to +14%) and good profit margins (14% and rising to 16%).

Topline growth is currently being slowed by a number of factors. These include the general economic pressures and ongoing operating cost increases, including rising venue fees. Yet there is also a lasting effect from the extreme lockdowns of 2020-21, with some localised health and travel restrictions, as well a shift in attitudes regarding business travel generally. All of this is making many event organisers focus more on domestic and regional events rather than rapid international expansion, although the approach varies a great deal from company to company.

Where is the LE money coming from?

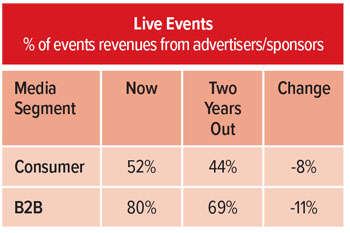

In terms of the revenue sources, the B2B model is still massively dependent on advertisers / exhibitors / sponsors (80%) versus delegates / users, although this dependence is rapidly reducing. That dependence is also reducing for Consumer, but at a slower pace and from a lower base. The strategic intent to shift the business model into user revenues is happening, but it is still an advertiser-skewed industry.

It is still a Physical First business

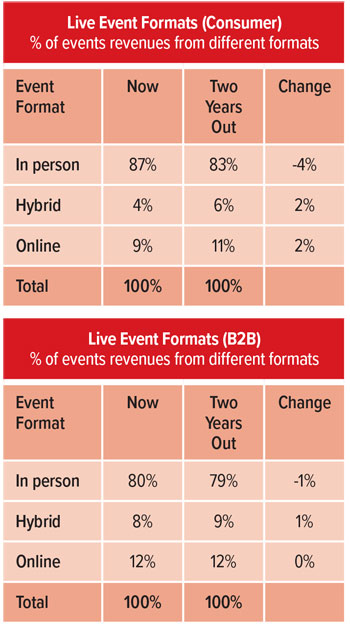

In terms of formats, Consumer and B2B have grown closer together. Both have returned, post-pandemic, to Physical First revenue models, although this is more pronounced in Consumer.

- The hybrid format is very demanding in terms of tech and content planning. It has a place, but a limited one, although its revenue share is edging up.

- Pure online events now have a more clear-cut role, but their margins are very slim – the tightest of all the formats.

LE 2.0 = a digitally enhanced LE 1.0

The new version of Live Events in some ways looks very similar to the old model and is still heavily founded on in-person activity and advertiser support. Before the pandemic, LE formats were fragmenting into a wide range, from small roundtables up to massive mega-events. That polarisation has accelerated, but with some more obvious digitally-enabled overlays. These include all-year-round content for the community being served (with a subscription model being the aim of many brands), smarter and more targeted marcomms and more sophisticated online marketplaces. Also, smarter digital tools can make the live event itself more targeted and pre-planned (and, therefore, more rewarding) for the visitor rather than the haphazard “serendipity” of the past.

However, this brings all kinds of challenges and questions for LE operators … Do we have both the volume and quality of content to deliver a 365 information service? Do we have the tech stacks to serve that content across multiple channels? And to monetise it? What are the metrics to measure RoI? Do we have the required skills in the company to make all this happen?

For many companies, this means running a very different kind of business to their old, legacy operation. LE 2.0 is content-driven, customer-focused and digitally-sophisticated, based on information provision, community hubs and robust RoI metrics. It is an exciting, but very challenging opportunity. And for many, acquisition is the quickest way to get there. That’s what Informa hopes anyway.

About mediafutures

mediafutures is an annual benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing and Collingwood Advisory. For a copy of the full mediafutures report, contact Jim Bilton: jim@wessenden.com

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.