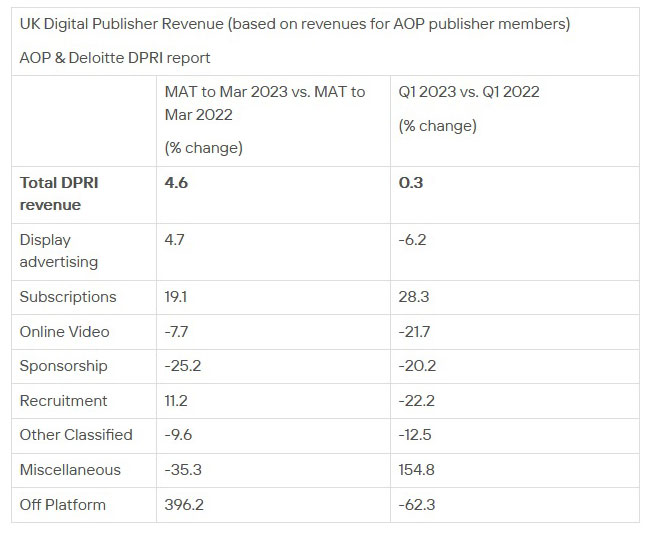

Following more than 12 months of consistent growth, subscription revenues now stand at £46.2million in Q2 2023, up by 28.3% compared to the same quarter last year. While digital audio has seen a significant increase of 171.4%, it represents a smaller percentage of overall revenue at £1.9 million, indicating it remains a niche revenue stream. Display format and video revenues have declined again, at -6.2% and -21.7% respectively.

The “miscellaneous” category reported the largest YoY increase after digital audio at 154.8% — from £3.1million to £7.9million. This is likely driven by data monetisation (which is included in the category) with increased activity around interest-based audience segmentation.

The results of the report, published last week, reveal ongoing growth (12%) in multi-platform revenues – where revenue from campaigns contains more than one platform. Also reflecting this continued shift away from single-platform strategies and campaigns, were reductions in mobile-device (-28%) and desktop-specific (-21.1%) campaigns.

Taking a deeper look into multi-platform campaigns in Q2 2023 versus Q2 2022, audio is growing as a category (240%), alongside a small uptick in display (1.9%), pointing to more layered and tailored solutions across devices.

Looking at “off-platform” revenue, which encompasses digital revenue generated from content outside of publishers' platforms such as Facebook Instant Articles and Apple News, the report shows a peak in December 2022 at £31.4million, which has since been in decline month-on-month, dropping to £26.3million in June 2023.

All respondents in the survey (100%) believe that new products/services will remain a high priority for their business for the next 12 months. Cost reduction also ranks as a high priority for 75% of respondents – an increase from 50% compared to Q2 2022. Prioritisation of advertising revenue growth increased from 50% to 75%, while sentiment for prioritising non-advertising revenue growth increased from 66% to 100%.

Dan Ison, lead partner for telecommunications, media and entertainment at Deloitte, said: “Many publishers will be feeling the impacts of ongoing economic headwinds, while also managing the need to innovate and maintain consumer interest. It is therefore an impressive achievement for the industry to have registered more than twelve months of consecutive growth.

“Subscriptions and multi-platform campaigns continue to grow as publishers look to provide diverse offerings that are engaging to a broad audience. Publishers will likely be reassured by consumers’ continued willingness to pay for quality content. A continued focus on publishing unmissable and accessible content will be key in maintaining this growth.”

Richard Reeves, Managing Director at AOP, commented: “It’s encouraging to see that overall revenue continues to rise, albeit modestly and despite a challenging economic environment, though we do note the increased focus on cost reduction over the next 12 months. While subscriptions remain strong, we must remember publishers continue to navigate a range of industry challenges that directly impacts UX and revenue, from transparency, privacy, and the deprecation of third-party cookies, to bloated creative file sizes.”

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.