Let’s look at the picture that emerges from the latest wave of mediafuturesPULSE — the short-term tracker of key industry metrics that sits behind the main mediafutures project.

The topline industry trend

Media industry headcount dived in pandemic 2020, but then grew strongly in 2022, as reshaped organisations began to staff up again. Yet this was usually from a much lower base than pre-Covid and was led by B2B and by smaller companies. In 2024, total industry headcount is still growing, but this growth has slowed down markedly and has some complex undercurrents.

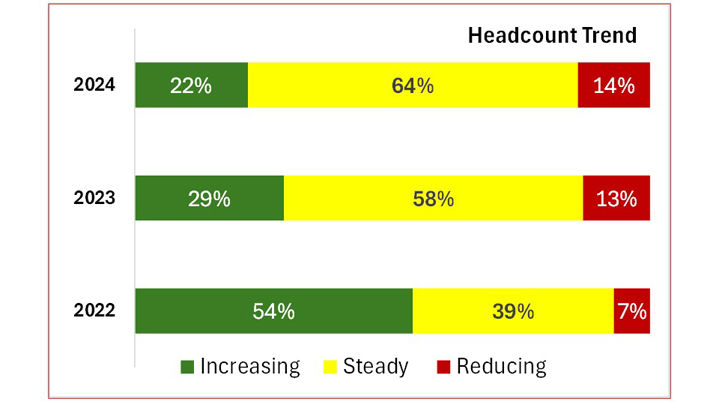

Respondents were asked: “Over the next 12 months, how do you see your total staff numbers changing?... increasing / steady / reducing?”

The number of companies increasing headcount has reduced from 54% in 2022 to 22% this year. The industry as a whole is still growing in terms of net staff numbers, but at a much slower rate, with most companies (64%) currently reporting a ‘steady state’. Yet beneath these toplines, much more is going on...

- The figures are much stronger in B2B (28% increasing headcount) than consumer (17%), which is actually shrinking in total staff numbers, whilst B2B is growing robustly.

- In terms of company size, it is the ‘medium’ and ‘small’ bands (under £10m turnover), which are growing the staff pool. Both the ‘major’ and ‘large’ company segments are shrinking in headcount. Here, an ongoing cull is still taking place, sometimes driven proactively and sometimes through natural wastage. This is helping to drive the improving profit margin performance of the larger organisations.

Headline productivity ratios

There is now even more focus than ever before on productivity: the growth of automation and the advent of new AI tools is helping many companies to double-down on this aspect of their operation. Yet this is not yet showing in improved productivity figures for a mix of reasons, some of them related to the scale and timing of AI investment.

The topline figure across the whole sample is £136,000 of turnover per full-time employee (FTE). This is down on last year’s £150,000.

- The range of performance remains wide, stretching from £40,000 up to £300,000. Consumer (£139,000) is slightly stronger than B2B (£133,000).

- The level of outsourcing is the single biggest driver of the ratio. Then, it is...

- ...company size. The ‘majors’ (£50m+ turnover), predictably, show the strongest figures (£200,000 average), whilst the ‘smalls’ (under £5m) stand at £125,000.

- Other important drivers include the geographic location of the business (impacting on general overheads, available staff pools and churn, etc) and the nature of the ownership: the business dynamics of PE-funded companies, PLCs and privately-owned operations are all very different).

Issues behind the numbers

Beneath the surface, there is increasing churn and some major issues that many companies still have to resolve. These include:

- Staff costs & retention. In a competitive job market, the salary bill is rising and holding on to good staff is a linked and growing problem.

- Staff churn. There is a clear — and usually deliberate — loss of more senior, older (more expensive) execs, with an influx of younger (cheaper) staff. This is radically changing the profile of many organisations, resulting in...

- ...staff ‘greening’. The average age of most companies is getting younger. This is bringing in new skills (essential) and new attitudes (a real mix of the positively challenging and the negatively disruptive). There are clear downsides to this greening process, one of them being the loss of corporate memory and valuable experience. ‘Re-inventing the wheel’ is a common danger.

- More outsourcing is taking place in order to control costs and to become more flexible and responsive to changing conditions. A number of smaller companies are looking at ‘fractionalisation’ — sharing specialist staff with other publishers.

- Automation is delivering real productivity gains for a number of operations, but often this investment takes some to feed into the revenue-per-head metrics.

- Executive burnout & mental health stresses. This is seen across all ages and pay-grades. The pace of change is unrelenting and the ‘to do’ lists just get longer.

- Working-from-Home and the New Workplace. The work-life balance is now a massive issue and not just for Gen Zs and Millennials. Many companies are still feeling their way into how to set workable and fair WFH practices, sometimes department-by-department and role-by-role. This comes at a time when recent research suggests that WFH can also depress productivity and creativity, as well as increase it. There is also a major rebalancing in the value exchange between employer and employee: again, another real mix of pros and cons.

All of this is stress-testing internal culture and values (which should and must be relatively stable and consistent), organisational structures (necessarily in constant flux) and skills...

...Reskilling the organisation raises lots of questions. What capabilities are actually needed? How much is the company prepared to pay to get the right people? How much value is now placed on experience and market knowledge? Do you rent the new skills (outsource), buy them in (recruit new people with new skills) or upskill existing staff? Each route has its own cost dynamics and speeds of implementation.

Increasing M&A activity is driving many organisations forward in terms of business growth, but it can also create major disruptions in culture, organisation, ways-of-working and tech stacks.

For a creative industry, managing staff talent has never been more important, complicated or costly. AI tools are part of the answer, but having the vision and the metrics to track the journey are also essential.

mediafutures is an ongoing benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing. Now in its 16th year, it maps the key drivers, metrics and issues that are transforming the shape and direction of the whole media business. mediafuturesPULSE is a new, more regular tracking survey of key industry performance metrics.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.