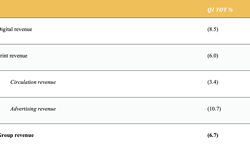

Highlights as reported by National World:

Chairman, David Montgomery, said: "National World continues to make strong progress on three fronts - growing revenue in the face of a general sector decline, driving organic development with innovative product and platform launches and finally through a targeted acquisitions strategy.

"Our transition towards full automation of content production processes has accelerated in the first half. There is greater focus on pivoting the workforce towards highly monetisable specialist content across all platforms, particularly higher yielding video, business information and events. Consequently, we are differentiating the Company as a leading innovator with a continually expanding reach.

"Subject to shareholder approval, we confirm the intention to pay an increased final dividend of 0.55p on 10 July."

Trading

Total revenue for the period has improved by 18% year-on-year, benefiting from both growth in print advertising and acquisitions completed in 2023 that were not in most of the comparative period. Total revenue was up 19% in Q1, followed by 16% growth across April and May.

Digital revenue is trending at +11% year-on-year for the period, despite the general audience malaise across the sector.

Print advertising revenue growth of 20% in the first quarter has continued in April and May, with signs of improvement in certain areas of the advertising market and helped by acquisitions.

Events revenue growth of 120% includes Insider Media events revenue, which the Group acquired in April 2023.

Acquisitions

Management continues to look at potential value-creating acquisitions that align with the Group's strategy as it repositions the business towards its new operating model, underpinned by greater productivity in specialist and original content.

Financial position

The Group maintains a strong financial position with a cash balance of at least £10.0 million at the end of May and no debt (May '23: £24.4 million).

The Board has recommended the payment of a final dividend of 0.55p per share in respect of the 2023 financial performance. If approved the dividend will be paid on 10 July 2024 to shareholders on the register at 7 June 2024. Payment of the final dividend will cost the Company approximately £1.5 million.

Outlook

The Company remains confident that investment in and development of its products across all platforms, together with the adoption of its new operating model and ongoing cost initiatives, will continue to support profitability and cash flow. Management expects performance for the full year to be in line with the Company's expectations.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.