As reported by News Corporation:

Fiscal 2022 Third Quarter Key Financial Highlights

- Revenues in the quarter were $2.49 billion, a record for third quarter revenue and a 7% increase compared to $2.34 billion in the prior year

- Net income in the quarter was $104 million, an 8% increase compared to $96 million in the prior year

- Total Segment EBITDA in the quarter was $358 million, a 20% increase compared to $298 million in the prior year, and includes $15 million of one-time transaction costs

- In the quarter, Reported EPS were $0.14 compared to $0.13 in the prior year – Adjusted EPS were $0.16 compared to $0.09 in the prior year

- Dow Jones reported its highest third quarter revenue since its acquisition with 16% growth and saw continued digital subscription gains as well as strong performance in advertising

- As of the end of March, Foxtel’s total paid streaming subscribers grew 62% compared to the prior year with both BINGE and Kayo at approximately 1.2 million subscribers

- Digital Real Estate Services segment revenues grew 19% in the quarter and Segment EBITDA expanded 17% despite a difficult prior year comparison

- News Media continued to benefit from the rebound in the advertising market, new content licensing revenues and strong digital subscriber gains

Commenting on the results, Chief Executive Robert Thomson said: “News Corp revenues and profitability set new records for the third quarter, building on the momentum of preceding record quarters. We have now achieved more in profitability through the first three quarters of fiscal 2022 — at over $1.3 billion and rising 27 percent compared to the prior year — than in any entire fiscal year since our rebirth in 2013.

For the third quarter of fiscal 2022, News Corp delivered $2.5 billion of revenues, up 7 percent, despite significant currency volatility, while profitability improved by 20 percent, including one-time transaction costs for the OPIS acquisition. That growth has been underpinned by our continued transformation to a digital-led company. We benefited from a surge in digital advertising revenue, including 21 percent growth at Dow Jones, and more than 15 percent growth in paid digital subscribers across our key markets.

The acquisition of OPIS, along with Base Chemicals, expected to close by the end of next month, represent an exciting opportunity for Dow Jones, extending the depth and reach of our news and information capabilities in the commodities sector. The appetite for data, analysis and insight in the energy, renewables, chemicals and related fields is strong and growing, and we believe Dow Jones is now well positioned to capitalize on that burgeoning opportunity.

News Corp is a company transformed, more intensely digital and global, with strong growth in our core markets and much unrealized potential. Macroeconomic challenges affect all businesses, whether it be supply chain pressures or inflation. But our collective resilience, adaptability and creativity, already stress-tested by the pandemic, have contributed to record revenues and profits.”

Third Quarter Results

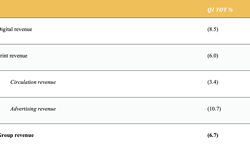

The Company reported fiscal 2022 third quarter total revenues of $2.49 billion, a 7% increase compared to $2.34 billion in the prior year period. The increase reflects growth in all revenue lines, including the impact of recent acquisitions, partially offset by the $85 million, or 3%, negative impact from foreign currency fluctuations. Adjusted Revenues (which exclude the foreign currency impact, acquisitions and divestitures as defined in Note 2) increased 6%.

Net income for the quarter was $104 million, an 8% increase compared to $96 million in the prior year, reflecting higher Total Segment EBITDA, as discussed below, and lower tax expense, partially offset by lower Other, net and higher interest expense.

The Company reported third quarter Total Segment EBITDA of $358 million, a 20% increase compared to $298 million in the prior year, primarily due to higher revenues, as discussed above, and lower costs in the Other segment due to lower employee costs driven by stock price performance. The growth was partially offset by higher costs at the Dow Jones, Digital Real Estate Services and Book Publishing segments, which reflects the impact of recent acquisitions including $15 million of transaction costs related to the acquisition of OPIS. The growth was also partially offset by the $16 million, or 6%, negative impact from foreign currency fluctuations. Adjusted Total Segment EBITDA (as defined in Note 2) increased 25%.

Net income per share attributable to News Corporation stockholders was $0.14 as compared to $0.13 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.16 compared to $0.09 in the prior year.

Please click here for the full Earnings Release information.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.