As reported by Reach plc:

Customer Value Strategy driving performance, on track to deliver full year expectations

Jim Mullen chief executive: “We are pleased to have delivered further operational progress this year, with our commercial and editorial teams making the most of the strong news agenda.

“Our Customer Value Strategy continues to deliver long-term success, with an increasing share of data-driven digital revenue as well as digital growth returning in Q2. Alongside our expertise in managing our print product, we have traded our digital assets hard and delivered an operating margin improvement.

“We continue to build a stronger, more resilient business and are on track with our plans for the year.”

Results overview: Improved operating profit margin through effective cost management

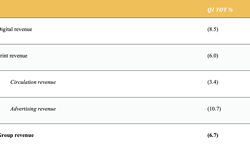

- Revenue declined 5.2% to £265.0m with digital revenue of £60.0m broadly in line with last year (HY23:£60.8m), and momentum improving across the period (Q124: (8.5)%, Q224: +6.7%).

- Both print circulation revenue £149.9m (HY23: £155.4m) and print advertising revenue £32.7m (HY23: £37.0m) outperformed volume decline, which remains in line with historical trends.

- Early and effective action on costs has delivered targeted cost savings. Total adjusted operating costs reduced by 9.3% to £221.8m (HY23: £244.6m).

- Adjusted operating profit increased by 23.1%, and at an improved margin of 16.8% (HY23: 12.9%, FY23: 17.0%).

- Continue to deliver returns for shareholders with the interim dividend maintained at 2.88p.

Further progress with our Customer Value Strategy

- The Customer Value Strategy is driving data-driven revenue growth of 9% to £27.2m (HY23: £24.9m). These revenues now represent 45% of total digital revenues (HY23: 41%).

- Strong trading of digital assets, along with continued diversification into non-advertising revenues, including partnerships, ecommerce and affiliates. As a direct result, yield (revenue per thousand page views) increased by 32%.

- Growing secure audience by 4% year-on-year, including 9m customers receiving content directly to their devices.

- Page view volumes declined 25% over the period due to ongoing impact of 2023’s referrer deprioritisation of news. Trends are improving and open market prices for mass scale programmatic advertising have stabilised.

FY24 Outlook: On track to deliver market expectations

We remain focused on delivering our operational plans for the year as we build a more sustainable digital business. Our Customer Value Strategy is continuing to grow data-driven revenues and we expect our print performance to remain resilient despite the tough macro backdrop.

We are trending slightly ahead of a full year reduction in operating costs of 5-6%. The phasing of cost initiatives and inflation during 2023 and 2024 means that operating profits will be more equally weighted between the first and second half of the year.

At the end of the period, we saw elevated levels of advertising spend supported by events such as the European Football Championships. July is trading in line with our expectations.

We continue to work against the backdrop of the dominant tech platforms and their impact on search and referral traffic. As we have seen, this dynamic can create some volatility across our distribution, however, we are building more resilience through our Customer Value Strategy and we remain on track to deliver market expectations.

Q2 Trading: Digital revenue back in growth

The performance over the second quarter has been bolstered by strong multi-platform content around key events, including the European Football Championships, UK general election and Taylor Swift Eras tour. As expected, yield continued to improve, driving growth across the digital estate. We remain focused on optimising our digital inventory with the increase in yield more than compensating for the 16% decline in page views.

Data-driven revenues, which are higher value and enable more targeted advertising, now make up 45% of digital revenues. Across the quarter these revenues grew 13% (year-on-year) due to the strong growth in direct advertising revenues and non-advertising revenues, including partnerships, ecommerce and affiliates.

Mass-scale programmatic advertising market has benefitted from a stabilisation in open market prices. It is too early to characterise this as a recovery, but the early indicators are positive.

In Print, circulation revenues have proven again to be a reliable revenue stream and the teams have mitigated the circulation volume headwind with cover price increases, strong promotional activity and standalone products tying into popular events. Print advertising revenue performed well due to the continued demand for this ad format, particularly from the food retailers.

To read the report in full, click here.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.