As reported by Reach plc:

Business Highlights

Investment driving stronger digital mix with higher yielding, data-led products continuing to outperform

- Strong growth in revenue from data-led products e.g. PLUS+; now over 30% of total digital (less than 20% H121)

- Traffic and audience outperforming publishing sector - page views and UK audience up 8% and 2% respectively

- Around 25% of total UK audience registered, with registered users now over 11m (from 5m in 2020)

- Engagement and loyalty growing; page views per user +2%, loyal users +17%, registered page views +103%

Print cover price increases help mitigate impact of lower yield on open market programmatic advertising

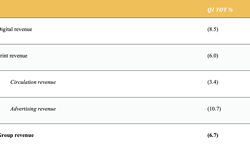

- Digital revenue up 5.4%; Q2 affected by Ukraine impact on brand safety and sector slowdown in advertiser demand

- Yield on open market programmatic advertising (affects c. 50% of total ad volume) in Q2 down 40% year-on-year

- Cover price increases and resilient volume performance drive stronger circulation with print revenue down 3.9%

- Overall revenue down 1.6%; expect stronger circulation revenue to counter impact of lower digital yields in H2

H1 profit impacted by newsprint cost; management actions strengthen outlook for H2

- Energy prices fuelling all-time high newsprint cost; not forecasting any improvement during FY22

- Savings from operating model changes and cost management mitigating H2 newsprint impact

- Timing of increased cover prices, management of costs and normal event-driven seasonality, supporting stronger than recent H2 contribution to operating profit

Jim Mullen chief executive: "We are making steady and significant progress in delivering our Customer Value Strategy. While the macro- environment is naturally presenting challenges, we’re committed to investing in the data and digital capabilities that are shaping the future of our business. Our ongoing strategic transformation strengthens us financially and operationally while we continue to deliver positive change through our editorial impact.

"We have acted swiftly to address the headwinds facing the business and expect the further cost efficiencies and cover price increases to mitigate the impact of newsprint inflation and reduced advertiser demand which are affecting the whole sector.

"Our strategic shift towards greater customer engagement and data-driven revenue is driving a more sustainable and profitable future. We are a stronger, more streamlined, and more efficient organisation, with the Group well placed to benefit once industry trends return to more normalised levels of activity. In addition, the strength of our balance sheet and cash generation underpin both a growing dividend and continued investment as we transition to an increasing mix of higher quality digital earnings.”

Results overview

Group revenue marginally down – stronger circulation mitigating impact of lower digital yield

- Print revenue £223.4m down 3.9% - circulation and advertising down 5.1% and 9.9% respectively, printing and other revenue up 19.0%

- Additional cover price increases strengthen circulation revenue with minimal adverse impact on print volumes

- Digital revenue £72.5m (H121: £68.8m) up 5.4% (Q2: 0.3%) against strong prior year comparatives

- Lower digital growth in Q2 with less brand-safe advertising space, resulting from the war in Ukraine and a market driven reduction in advertiser demand, reflected in lower yields for open market programmatic revenues

- Strategy delivering improvement in digital mix with significant growth in higher-yielding, data-driven revenues which were around one third of total digital in the period

H1 profit impacted by cost of newsprint; timing of cost actions and cover prices drives increased H2 weighting

- Adjusted operating profit £47.2m down 31.5% (£21.7m); reflecting unprecedented increase in newsprint cost which was up £14m or £17m (c.65%) on a like-for-like volume basis

- Acceleration of operating model changes enabling further significant efficiencies in H2, in addition to savings from changes to print production and distribution

- Statutory operating profit £34.5m (H121: £28.6m) up 20.6%, driven by significant year on year reduction in operating adjusted items £12.7m (H121: £40.3m)

- Statutory EPS of 8.1p (H121: (11.2p)) significantly ahead driven by property rationalisation charges and reflection of future change to UK corporation tax rate, in last year’s comparator

Cash & Capital Allocation

- Adjusted operating cash flow of £39.2m (H121: £82.6m) represents cash conversion of 69% with neutral working capital position versus positive inflow in comparator period due to non-repeating trading timing benefit

- Retained cash decreased by £21.9m to £43.8m, after payment of FY21 final dividend and penultimate payment for acquisition of The Express and Star

- Further reduction in IAS19 pension accounting deficit to £69.1m (FY21: £117.2m); yet to achieve resolution of 2019 triennial review of pension commitments

- Board recognises the importance of a growing dividend for shareholders - interim dividend of 2.88p up 4.7%

Building a culture fit for the future

- New family friendly policies, including more support for carers and continued hybrid flexibility for staff giving us clear offering in a competitive talent market, alongside continued progress around Diversity and Inclusion

- Work to formalise sustainability strategy and net zero target ongoing; plan to disclose as part of full year results

Outlook and current trading

Over the past three years, the evolution towards a more digitally focused operating model has made us a more agile and more efficient business, with our Customer Value Strategy driving a more sustainable, longer term growth trajectory. The phasing out of third-party cookies and evolving trend away from creative display in favour of more performance led advertising is creating opportunities for growth, with our continued investment in data-driven digital solutions, supporting higher and more predictable returns.

We expect PLUS+ and other data-driven revenues to continue to outperform during H2, though expect yield on open market programmatically driven revenues will remain depressed, reflecting broader macro pressures. We therefore expect total H2 digital growth to remain subdued. Circulation will benefit from a full half of increased cover prices during H2, strengthening print revenues.

We expect a year over year improvement in total operating costs during H2, with the benefit of further strategically driven changes to our operating model and additional cost management actions mitigating the impact of inflation and preserving our ongoing investment plans. We do not anticipate an improvement in the existing rate of newsprint during the second half.

In the context of an uncertain macro and political climate, we remain mindful of the risk of further deterioration in economic conditions. We currently expect management actions and the natural phasing of our business, to support a stronger than historical H2 profit contribution.

The full report is available here.