It was on the back of a napkin at a restaurant lunch in the aftermath of the credit crunch that Rory Brown came up with the concept for a new media venture with fellow media exec Neil Thackray.

Brown, former managing director of the interactive marketing division at Incisive Media, had recently gone out on his own, while Thackray had been the chief executive of Quantum Business Media, erstwhile publisher of Media Week and Press Gazette.

Brown, now CEO of AgriBriefing, an agribusiness media and intelligence company, recalls: “We’d both been trying to buy something of substance to develop in business media. We had shared views about where business media and information markets were going and the way some of the traditional large scale publishers had been getting things wrong. The business model was clearly being disrupted by digital transition, advertising markets were changing, the way in which you provide subscription information and data was becoming more important.”

“We decided at a restaurant lunch on the back of a napkin in traditional style that we would go 50/50 on what we did, and we would try and launch something in the meantime.”

They launched a business that was originally called Briefing Media together with a website called The Media Briefing which aimed to share best practice in the media industry. As kitchen table start-ups go (or in this case restaurant table) it went pretty well, and when UBM came along and asked if they were still interested in buying anything, the pair got the chance to practice what they preached.

We changed the mindset from being an industrial process of magazine production into much more of a services and membership proposition.

First acquisition

Brown recalls: “We looked through the portfolio they had and came across a magazine called Farmers Guardian which was a weekly magazine for farmers based up in the north-west of England in Preston. Farmers Guardian for 175 years had been providing a very traditional trade magazine format for farmers across the country.”

“At the time we saw it, it had about 35,000 paid customers every week and about 2,500 advertisers. All sorts of people ranging from auction markets to people selling livestock or tractors and machinery. The farming enterprise is the ultimate SME: they’ve got a whole lot of money going through, a whole load of business decisions that they’ve got to make, but they don’t tend to work in a corporate environment. They have to make all these decisions themselves.”

They raised some money from a small private equity firm to buy Farmers Guardian and set about thinking about how they could change that “very traditional old school trade publishing business” along the lines they had been suggesting in The Media Briefing. The first thing they did was to go and speak to the team in Preston.

We could double the average revenue per customer because they had access to all of these other services.

Rethinking the business

“We set them a challenge; we said, ‘If we don’t have to publish this magazine every week, but none of you were made redundant, what are you going to do to help farmers do their job better?’ They came up with lots of ideas: we could set up a legal helpline; we could set up a buyers’ group for farmers to negotiate the price of their inputs more effectively; we could launch an exhibition for people who are looking for the best tractor or combine harvester; or we could build a digital marketplace. We said great, let’s go and do all those things and of course we’re not going to stop publishing the magazine because that would be stupid. We changed the mindset of the business from being an industrial process of magazine production into much more of a services and membership proposition for farmers.”

AgriBriefing was born. They bought a small trade show dealing with farming machinery and launched another, called CropTec, for precision farmers, showcasing technological developments in the industry. Then they added lots of extra elements to their membership proposition.

Brown says: “We grew what was a two thirds newsstand and one third subscription service into a largely subscription service and then layered on an additional membership proposition on top of that. What that allowed us to do was to have much more direct contact with our customers, so we grew the subscription base from about 12,000 to 20,000 a week. We could double the average revenue per customer because they had access to all of these other services, a grant checking service or a legal service or a buying group etc. We built out the digital proposition and we built out the events portfolio, so the small trade show that we bought is now four times the size and now held at the NEC rather than outside in a field. The event that we launched around technology is now a £500,000 event. Over three years, we more than doubled the profits of the business, which had been a very high margin business in the first place and built up this great franchise.”

International expansion

By 2015, they were in a position to grow the business further and expand internationally. They changed investors to a new private equity partner with greater scale and bought a business in Toulouse, France, called Feedinfo, a price reporting agency for the agricultural commodities that go into animal feeds.

“Feedinfo had set up publishing the prices for some nutritional supplements, enzymes and amino-acids and vitamins that go into animal feed. This sounds really niche, but actually it is a $20billion traded market every year. This business which had been set up by a trader turned out to be just a fabulous business. The customers loved it, but it was under-invested in, it had no real marketing expertise, no real outbound sales expertise. The technology was still very outdated from the 1990s, so we set about professionalising that business, hiring account managers in different parts of the world, updating the technology and the business grew very substantially in a quick period of time.”

Before buying Feedinfo, AgriBriefing engaged a professional research firm to carry out an extensive interview process to help it better understand its customers.

“Our job is to help our customers do their job more efficiently. Once we understand that and once we have a platform of integrity and trust within that marketplace, then it is about detailed product requirements developing new services for those customers. It might be ‘Can you extend your pricing service to new commodities?’ Yes, we can. Or it might be ‘What we would really like to do is monitor our competitors’ scientific developments. Can you provide a database for patents which are coming up in this space?’ Yes, we can. It’s about understanding what the customer needs and what they would value and then investing to deliver that service on the understanding there is a commercial advantage if you can answer that pain point.”

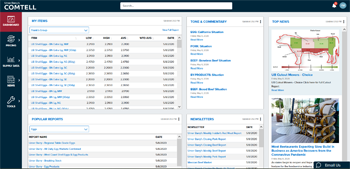

The next stage of expansion was buying another price reporting business, this time based in New Jersey in the United States, called Urner Barry, which had published benchmark prices for chicken, eggs, red meat and seafood for 160 years.

“Urner Barry was of a different scale to Feedinfo but doing the same type of job in a different part of the agricultural supply chain. Again, when we went into that business we said, ‘What business are you in?’ There were 70 or 80 people in New Jersey who had been working in this business for a long time and they said, ‘We’re in the meat business’, ‘We’re in the seafood business’, and we said, ‘That’s interesting but have you heard of commodity price reporting and data in other businesses?’ It was starting to change the mindset of the people within that business, so their job was how do I help my customers do their job better? The irony of that business was that in 160 years of operation, they had never written a formal budget. Putting in professional processes in what had been a family owned firm led to very substantial growth, both in the home market in North America, but increasingly we’re expanding out into global markets as well.”

What next?

Today, Brown leads a company of around 200 people with customers in 150 different countries (Thackray left the business before the last cycle of private equity investment).

He says: “The agricultural markets globally are still very fragmented, they either have a regional focus, or they tend to be very focused around the individual commodity classes. There’s still a huge opportunity for us to build more and more platforms for the group either organically or through acquisition. Already we are one of the largest agricultural information businesses globally.”

Brown believes AgriBriefing can serve the entire agribusiness supply chain from the farmers and intermediary traders like Cargill or Louis Dreyfus, to the big food giants such as Nestle and Unilever and the supermarkets and restaurants at the end distribution point.

Events, including exhibitions and conferences, make up around 25 per cent of the company’s revenues, which have been affected by this year’s Coronavirus pandemic, but Brown stresses that this only goes to show how key diversification is to success.

“We’ve always had a multi-platform approach; we understand value creation and that robust subscriptions renewal businesses are more valuable than other forms of revenue. That doesn’t mean we don’t see the value in providing events, exhibitions, conferences all sorts of things for our community because they want them. It all goes back to my underlying point about the importance of answering pain points and helping your customers do their job better.”

Going forward, Brown hopes to further consolidate the diverse but linked businesses his company has acquired over the last decade. He says: “This isn’t rocket science what we’ve done, but it does have an underlying theme all the way through it which is, you can create value if you really understand your individual communities and what they need, and spend proper time and money developing those to deliver significant value for money to your end user and if you do that in multiple ways, you cement your position within the industry. We are seen as part of the industry. We help that industry function and the industry wouldn’t operate nearly as efficiently without us. You become less of a discretionary spend and much more embedded in the markets you serve and that’s a hugely powerful place.”

There’s still a huge opportunity for us to build more and more platforms for the group either organically or through acquisition.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list, please register here.