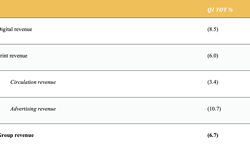

According to Guardian Media Group:

Financial summary

• Group revenues £214.5m, up 2% (2016: £209.5m)

• Digital revenues £94.1m, up 15% (2016: £81.9m)

• Costs before exceptional items £19m lower at £259.2m (2016: £278.2m)

• EBITDA before exceptional items £44.7m loss, 35% lower than in prior year (2016: £68.7m loss)

• Investment disposal: GMG completed the sale of its 22.4% stake in Ascential plc for a total of £239 million

• Investments and cash holdings totalling £1.03bn following 20.6% increase in value of endowment fund and sale of Ascential stake

Strategic progress

Guardian Media Group has completed the first year of a three-year transformation plan to increase revenues by building deeper relationships with readers, align its advertising business to market growth, and reduce costs.

• Reader relationships: at the end of 2016-17, Guardian News & Media (GNM) had more than 400,000 regular paying members and subscribers to our print and digital products. More people are paying for Guardian journalism than ever before.

• Aligning advertising business with growth: Group continues to refine and improve its advertising proposition, taking account of rapid changes in the print and digital advertising markets.

• Reshaping the organisation: GMG reduced headcount in 2016-17 by approximately 300 roles.

• Audience/readership: more than 140 million monthly unique browsers consistently engage with Guardian journalism online.

Despite turbulent trading conditions and advertising volatility across the media sector, Guardian Media Group reported revenues of £214.5m, up 2% on the previous year, as the Guardian continued to strengthen its relationship with its readers and saw good growth from Guardian US and Guardian Australia.

Regular readers of theguardian.com increased by 17.4% between March 2016 and March 2017. More than 400,000 are regularly paying members or subscribers. Mobile and app revenue, digital subscriptions and memberships, one-off reader contributions and foundation grant revenue helped lift digital revenues to £94.1m, up 15%.

In a significant move towards securing GMG’s long-term future, the value of the Group’s investments and cash holdings has risen to £1.03 billion. This was due to a 20.6% increase in the value of the Guardian’s Long Term Endowment Fund and the sale of GMG’s 22.4% stake in Ascential plc, the international business-to-business media and events group, for a gross consideration of £239m.

During the year, GMG reduced its costs by £19 million to £259.2m, and reduced headcount by approximately 300 FTE roles. These moves, painful though necessary, enabled the group to reduce losses at the EBITDA level by 35% to £44.7m before £9.6m of exceptional costs.

GMG has continued to implement the three-year plan launched by David Pemsel, CEO, and Katharine Viner, editor-in-chief of Guardian News & Media, in January 2016.

The plan aims to:

• Address the balance of costs and revenues at Guardian Media Group, focusing on new revenue streams including reader revenues and international growth

• Build a far deeper set of relationships with our audience; and

• Reduce the Guardian’s cost base by 20%

The Guardian is on track to achieve the aim of the plan, to break even at an EBITDA level by 2018/19, and for the Guardian Media Group to become financially sustainable in perpetuity.

David Pemsel, chief executive officer, Guardian Media Group, commented: “Despite the challenging market conditions faced by all news organisations around the world, our three-year strategy is well on track to achieve its financial goals and to secure the future of the Guardian. We are reducing our costs, growing new reader revenue streams, and developing our businesses in the US and Australia.

“We have grown our digital revenues, and we are achieving strong growth in membership, subscriptions and contributions. More people are paying for Guardian journalism than ever before. This is helping to build a strong foundation from which we will continue to invest in some of the most trusted journalism in the world.”

Neil Berkett, chair of GMG, said: “This set of results are a testament to the hard work of the management team and of everyone at Guardian Media Group. There is much to do, but the strategy is on track.

“The successful disposal of our remaining shares in Ascential means that the business has a clearer focus and more secure financial base from which to complete our three-year strategy and ensure that we continue to create world-class Guardian journalism in perpetuity.”

On 13 June, the Guardian announced plans to move the Guardian and Observer print titles to tabloid format, from early 2018.