National World report as follows:

Commenting on the results, Executive Chairman, David Montgomery, said: "The enhanced performance and significantly increased profits are the result of expert integration of acquired businesses and also an energetic restructure of the operating model based around original, monetisable content, re-skilling of the talent base and greater engagement with registered customers.

"We are investing in both automated processes combined with the development of a social media platform that deepens the relationship with communities and interest groups to win back key marketplaces.

"At the same time our expert and specialist content, in areas such as business and sport, is exploiting a national footprint that in future will be better represented by the Group to promote data and sales.

"National World is also alive to the attractiveness of consolidation, extracting immediate significant synergies and equipping acquired businesses with the innovative tools to grow exponentially."

- Total revenue up 17%, digital revenue up 12%, net cash balance of £13.0 million

- Total Revenue up 17% to £48.8 million, with a 19% year-on-year increase in quarter one, followed by a 16% increase in quarter two.

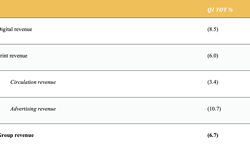

- Robust digital revenue growth, up 12% year-on-year to £10.0 million, bolstered by 2023 acquisitions. The business is transitioning away from page view (PV) metrics, towards what our customers and advertisers recognise as higher value content. This is demonstrated by our 12% increase in digital revenue despite a 4% decrease in PV, and a 25% increase in video revenue despite a 14% decrease in video views.

- Events revenues of £2.5 million represent an 92% improvement year-on-year, benefiting from having acquired Insider Media on 30 April 2023. 2024 is a transformational year for our events business with overall revenues expected to exceed £5.0 million. The Group will run 100 events throughout the year across the UKand 50 sector specific networking breakfasts. The sector specialisms include finance, property, manufacturing, community and apprenticeships. This business is in a highly rated marketplace and our 2024 growth makes it a meaningful diversification for the Group.

- Adjusted EBITDA of £5.0 million, up 61% and adjusted operating profit of £4.7 million, up 62%. EBITDA margin has improved to 10%, a 3 pps improvement on the prior period. Contributing factors to the improved performance are the benefit from the acquisitions completed in 2023 for which there is not a full period of comparatives and the Group's accelerated plans, which were delivered in the second half of 2023, to implement the new operating model.

Acquisitions and Disposals

On 31 March 2024 the Group disposed of Press Computer Systems Limited, ("PCS") to Naviga 1 UK Limited,("Naviga") which it had acquired six months earlier as part of the Midland News Association, ("MNA") acquisition. The Group has recorded a £1.0 million gain on the disposal of PCS in the Statutory Discontinued Operation results. Consideration of £3.5 million was received in the form of service credits which the Group will utilise against the five-year software agreement it has with Naviga. From 1 July 2024 onwards, the Group will benefit from a reduced adjusted operating cost base and cash out flow, which is expected to benefit the next four to five years until the £3.5 million service credit is fully utilised.

The Group has completed two acquisitions in 2024, with Athletics Weekly acquired on 31 May and Serious About Rugby League on 8 July, both acquisitions were funded from existing cash resources. The specialist content sites will enhance the Group's sports vertical.

- Strong balance sheet with significant financial flexibility, closing net cash balance of £13.0 million at 29 June 2024, with no outstanding debt.

- Dividend. A maiden interim dividend of 0.2 pence per share has been approved and declared by the Board and will be paid on 20 September 2024 to shareholders on the register at 9 August 2024.

On 30 May 2024, shareholders approved the payment of a 0.55 pence per share dividend which was paid on 10 July, in relation to FY23 performance.

Outlook

The Company's primary focus is to build a sustainable and monetisable content business, embracing its news provision tradition but with a wider agenda across all platforms. This pivoting of the business has continued unabated despite the economic headwinds in the first half.

Revenues in July have increased by 13% year on year. The Company will continue to benefit in the second half from three key drivers - the acquired businesses, new launches and relaunches of heritage brands. Tight cost management remains a critical factor as in the whole sector.

The Board confirms its view that the business will perform in line with market expectation for the full year.

Click here to read the full report.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.