Over three years on from the beginning of a global pandemic, you’d be forgiven for hoping our lives were returning to ‘normal’. But now, we’re beginning to see its knock-on economic impact: inflation, which is still over 7% in the UK, leading us into a possible recession.

With the price of goods rising, consumers are cutting back and becoming more price-sensitive. The Data and Marketing Association (DMA) 2022 report revealed over half of consumers see themselves struggling, and one in eight is “unable to stretch beyond essentials”.

So, what can publishers and brands do to mitigate the impact of the cost-of-living crisis on customer loyalty?

Ramp up brand activity

One counter-intuitive solution is to increase brand activity. However, many brands feel they’re under pressure to deliver short-term results. These pressures often translate into a cost-cutting vortex, which only dilutes their emotional connection to customers and discourages loyalty.

This short-term pressure also stifles creativity and innovation, both of which may take time, experimentation, and even a certain amount of risk to deliver meaningful brand building and awareness. By solidly investing in brand activity, brands can differentiate themselves from competitors and build a consistent narrative rather than slipping back into the cost-cutting marketplace.

However, to add to these challenges, many of the publishers we speak to say that although their brand advertisers want to invest in brand activity, they need to be able to measure its effectiveness accurately and consistently to justify that spend. So, how do you get consistent performance data you can measure? Essentially, by using brand lift metrics.

Measure the lift

As we all know, even if an ad doesn’t result in a click-through from a target customer, the messaging can have a significant impact on brand perceptions, which can lead to a conversion later on in the customer journey. But measuring this impact can be tricky without the right framework in place.

The essence of brand lift metrics is to measure the success of brand campaigns through four key areas: awareness, consideration, preference, and action intent.

As a publisher, when you use brand lift metrics over time, you start to build a bank of easily accessible insights into individual campaign performance and develop a deep understanding of broader consumer trends and what influences success, which can be used to build future strategies. Publishers and brands can also use this longitudinal data to justify expenditure on non-promotional activities and show how it’s working.

Don’t forget consideration as a metric

From the brand lift data we’ve collected across thousands of campaigns in multiple industries, our benchmarks have shown some interesting areas of growth in the consideration metric in 2023, compared to 2022.

As an example, for the gas / electricity category, consideration is up 18% from 2022, which could suggest that although customers may be locked into a current deal or find switching services a hassle, more people are starting to consider their alternatives.

This provides useful insight for utilities suppliers to ensure they are promoting their brand’s benefits, giving people reasons to consider them at the time they are evaluating their alternative options.

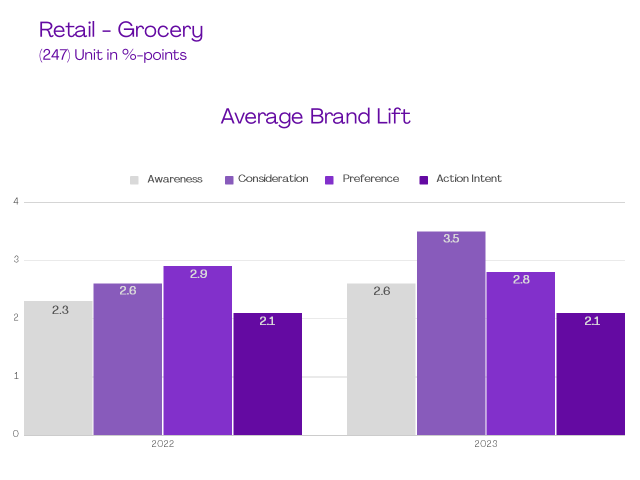

In the retail and grocery category, our data also shows an almost 30% lift in consideration, comparing 2023 against 2022.

This increase in the importance of the consideration metric may indicate that grocery retailers are becoming more aggressive in their marketing claims, thereby encouraging customers to consider more alternatives.

This again raises challenges for grocery retailers, especially thinking about how they can build brand consideration, without necessarily reducing prices.

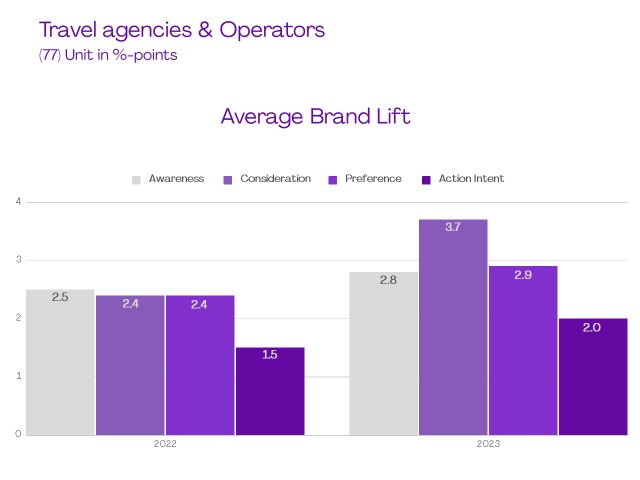

Also, in the travel agencies and operators sector, we’ve seen an overall increase in brand lift across all four metrics, suggesting that post-Covid, people are embracing travel again.

However, within this, there has been a 33% increase in the consideration metric in 2023 compared to 2022. When combined with a slight decline in preference, this data suggests people are now looking for holidays, but are hunting around more for the best value.

From these examples, we can see that consideration is forming an increasingly important part of the customer journey in various categories, which means publishers and their advertisers should be paying particular attention to this metric.

What’s more, this brand lift data is also backed up in the 2022 DMA report, which shows feelings of disloyalty among consumers increased to 41% (compared to the 34% that said they felt less loyal to a brand in 2020).

In these economically uncertain times, the prevalence of promiscuous customers means it becomes even more critical for brands to differentiate and inspire loyalty, whether through product quality, competitive advantage, added value, or other brand-building strategies that don’t just rely on reducing prices.

Collecting consistent data and monitoring brand lift performance enables publishers to help their advertisers reduce their reliance on short-term solutions and invest more in supporting their brands, thereby giving the brands a greater chance of mitigating the impact of external factors on customer loyalty, such as the cost-of-living crisis.

About us

Brand Metrics is a SaaS platform revolutionising campaign effectiveness measurement. Our technology seamlessly integrates with publisher tech stacks to measure digital campaign performance at scale, delivering simple, consistent brand lift data. This data enables publishers to grow their sales revenue and empowers advertisers and agencies to learn from the results and optimise future campaigns for greater effect. For more information, visit brandmetrics.com.