The various shocks of the last few years, including the Ukraine war and the Coronavirus pandemic, have accelerated the structural shift away from traditional formats such as print and linear TV towards more digital and mobile media. This transition has not been an easy one for publishers, many of whom have struggled to attract attention in a world of abundant media – and have found that much of the advertising revenue has moved to big tech companies such as Meta and Google. But now, data suggests that a new set of platform and format shifts are underway, which combined with rapidly changing audience expectations, are set to further disrupt the industry.

Digital News Report data collected using online surveys across 46 countries clearly illustrates the fraying connection between publishers and audiences. One measure of this shift is a question we ask about the most important gateways that people use to access online news. Using average data across all 46 markets, we find that more people chose social media each year, mostly at the expense of direct access via a traditional news website or app. Access via search and other aggregators has also increased slightly over time (see graph above).

These are averages, and it is important to point out that direct connection remains strong in some markets – mainly in Northern Europe – where there is keen interest in news and relatively high trust. But elsewhere, especially in parts of Asia, Latin America, and Africa, social media or other aggregators have become by far the most important gateways, leaving news brands much more dependent on third-party platforms.

Generational differences are also a big part of the story. In almost every country, we find that younger users are less likely to go directly to a news site or app and more likely to use social media or other intermediaries. This is just one indication of how the generation that has grown up in the age of social and messaging apps, is displaying very different behaviours as they come into adulthood.

Legacy social networks under pressure

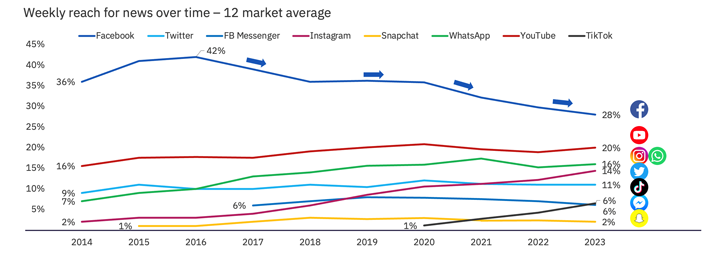

Dependence on social media may be growing, but it is not necessarily the same old networks. Across all age groups, Facebook is becoming much less important as a source of news – and, by implication, as a driver of traffic to news websites. Just 28% say they accessed news via Facebook in 2023 compared with 42% in 2016 (based on data from 12 countries we have been tracking since 2014). This decline is partly driven by Facebook pulling back from news and partly by the way that video-based networks like YouTube and TikTok are capturing much of the attention of younger users. Twitter usage is also reportedly on the slide following the chaotic set of changes introduced by Elon Musk, even if our survey in early 2023 shows relatively stable weekly reach overall.

Use of Facebook for news is declining, video networks on the rise

Across all countries, TikTok is the fastest growing social network in our survey, used by 44% of 18–24-year-olds for any purpose and by 20% for news (up five percentage points compared with last year). Data also show that the Chinese owned app is most heavily used in parts of Asia, Latin America and Africa.

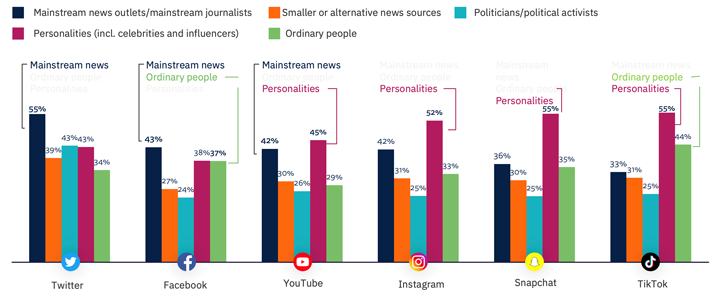

The report also provides evidence that users of TikTok, Instagram and Snapchat tend to pay more attention to celebrities and social media influencers than they do to journalists or media companies when it comes to news topics. This marks a sharp contrast with legacy social networks such as Facebook and Twitter, where news organisations still attract most attention and lead conversations.

Journalists are losing out to personalities and influencers in youth-based networks

Although many news organisations including the BBC and the Daily Mail have been experimenting with TikTok accounts, many are struggling to adapt to the more informal tone, where creativity is at a premium. These shifts are additionally challenging for publishers because they often require expensive bespoke content to be created and there are few ways to monetise short form videos, with limited linking opportunities back to websites or apps.

Younger groups are less likely to read online

These platform shifts are part of a wider move away from reading and towards watching or listening to news content online. While all age groups say they still prefer to read news online because of the speed and control if offers, younger groups are more likely to express preferences for watching or listening to news content. And this translates into greater consumption of short form videos and podcasts by this group. Across all markets, almost two-thirds (62%) consumed video via social media in the previous week and just 28% when browsing a news website or app. Facebook and YouTube remain the biggest outlets for online video, but with under-35s, TikTok is now not far behind. In an audio context, the vast majority of content is accessed through YouTube, Apple Podcasts or Spotify.

Growing consumption of news audio and video online means that platforms increasingly control which content gets discovered and to a large extent the rules around monetisation. These trends are likely to make it even harder for media companies to attract attention and build deeper relationships with consumers.

Recognising these challenges, a number of media companies have been attempting to build up their own audio and video destinations. Public broadcasters have started to include news exclusive content within their video on demand services and have been holding back at least some exclusive content for loyal users. In the audio space, the New York Times recently launched an app which included content from other providers. Nordic publisher Schibsted has bought a podcast platform, PodMe, and is building up a range of exclusive content in a bid to challenge networks such as Spotify as a destination for podcasts and audio books.

Audiences are increasingly ambivalent about algorithms and platform effects

TikTok’s powerful personalised content feed has refocused attention on the way algorithms can affect our media diets – especially those that deliver ‘more of what you have consumed in the past’. We find that people in many countries are less happy about the selection of content both from algorithms and from journalists than they were a few years ago. These changes are not significant in all markets, but there has been a bigger fall in satisfaction in content-based algorithms amongst younger users (who rely the most on them).

In interviews, respondents frequently express fears that social media may be pushing them down rabbit holes, though this could be related to increased commentary about these issues as much as actual experience. Either way, in this year’s data, we find continued high levels of concern that ‘overly personalised’ news could lead to missing out on important information or being exposed to fewer challenging viewpoints (similar to 2016). Concern about misinformation also remains high, especially amongst those that use social media the most.

These data highlight general audience dissatisfaction with both the quality of content in platform environments and how content is selected for them – and perhaps provides an opportunity for publishers to create something better. Many news organisations are now exploring how to mix their editorial judgement and values with algorithms in a way that delivers more relevant, reliable, and valuable content for consumers.

Business and societal impacts could be significant

Taken together, what are we to make of these changes in the platform environment? Audience reliance on social media continues to grow, but a growing variety of different platforms now compete to serve different purposes in people’s lives, with news often becoming less central to how they work.

Publishers have long complained about the power of platforms and the impact on their businesses, but the situation could be about get even worse. Traffic from traditional social networks such as Facebook and Twitter is falling away as audience attention switches to platforms such as Instagram and TikTok. But these multimedia networks often require more bespoke investment from publishers with little return in terms of referral traffic or revenue. These are also platforms where younger audiences are often less disposed to listen to journalists than they are to ‘influencers’ who look and speak more like them.

Compounding the problem, many fear that online traffic will be adversely affected by innovations in AI driven chat functions that are being built into Google and Bing search engines. Early prototypes show how information requests will be served up directly with fewer organic links to websites.

Against this background, publishers will need to focus more on building direct relationships with consumers and less on business models that rely on referral traffic to text webpages. Platforms will still play a key role in finding new subscribers and also with engaging younger audiences who remain reluctant to go directly to websites and apps. Digital audio and video content is likely to become more important over time, both for building relationships but also with monetisation opportunities emerging for premium content. The economic downturn has made it a challenging time for news publishing, but these platform shifts are adding an unwelcome extra layer of uncertainty.

You can read more detail about podcasting across countries and about wider audience trends at www.digitalnewsreport.org/2023

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.