As reported by News Corporation:

Commenting on the results, Chief Executive Robert Thomson said: “News Corp’s Fiscal 2023 results highlighted the durability and depth of our revenue streams and the impact of stringent cost controls as we navigated challenging macro conditions, supply chain pressures and currency headwinds. We achieved full year Fiscal 2023 revenues of $9.9 billion and profits of over $1.4 billion – the second highest profitability ever recorded by the Company. Our results showed marked improvement in the second half, so with inflation abating, interest rates plateauing and incipient signs of stability in the housing market, we have sound reasons for optimism about the coming quarters.

“For the first time, digital accounted for over 50% of News Corp’s revenues for the full year, marking a profound transformation during the past decade. That momentum is surely gathering pace in the age of generative AI, which we believe presents a remarkable opportunity to create a new stream of revenues, while allowing us to reduce costs across the business. We are already in active negotiations to establish a value for our unique content sets and IP that will play a crucial role in the future of AI.

“Dow Jones posted its highest profitability for both the quarter and the full year since we acquired the company – helped, in particular, by impressive results in the burgeoning professional information business. Not only has Dow Jones doubled its profitability over the past four years but it is also nearing a landmark moment with our lucrative B2B offerings expected to be the largest contributor to profitability in Fiscal 2024 and a key driver of future growth.

“At Subscription Video Services, while revenues and profit were impacted by foreign currency headwinds, we achieved growth for the fourth quarter and full year on an adjusted basis – a remarkable turnaround from the recent past and a tribute to the team in Australia. And that turnaround is underscored by Foxtel’s imminent completion of a refinancing, which is expected to facilitate repayments of our outstanding shareholder loans beginning in fiscal 2024.”

Fourth Quarter Results

The Company reported fiscal 2023 fourth quarter total revenues of $2.43 billion, a 9% decrease compared to $2.67 billion in the prior year period, including the absence of the $110 million, or 4%, benefit from the additional week in the prior year quarter and the $72 million, or 3%, negative impact from foreign currency fluctuations. The decline was largely driven by lower revenues at the Book Publishing segment primarily due to lower book sales and lower revenues at the Digital Real Estate Services segment driven by continued challenging housing market conditions in the U.S. and Australia. The decline was partially offset by higher revenues at the Subscription Video Services segment on a constant currency basis. Adjusted Revenues (which excludes the foreign currency impact, acquisitions and divestitures as defined in Note 2) were down 7% compared to the prior year. Adjusted Revenues does not exclude the impact from the additional week in the prior year.

Net loss for the quarter was $(32) million compared to net income of $127 million in the prior year, primarily due to higher income tax expense driven by the absence of a $149 million tax benefit from an adjustment to valuation allowances in the prior year, higher losses from equity affiliates as a result of a non-cash write-down of REA Group’s investment in PropertyGuru of approximately $81 million and higher impairment and restructuring charges, partially offset by higher Other, net and higher Total Segment EBITDA, as discussed below.

The Company reported fourth quarter Total Segment EBITDA of $341 million, an 8% increase compared to $315 million in the prior year primarily due to cost savings across the businesses related to the previously announced headcount and other cost reductions and lower costs at the Other segment due in part to the absence of one-time legal settlement costs of $20 million recognized in the prior year. The increase was partially offset by lower revenues, as discussed above, and higher sports programming rights costs at Foxtel. Adjusted Total Segment EBITDA (as defined in Note 2) increased 2%. Adjusted Total Segment EBITDA does not exclude the impact from the additional week in the prior year.

Net (loss) income per share attributable to News Corporation stockholders was $(0.01) as compared to $0.19 in the prior year.

Adjusted EPS (as defined in Note 3) were $0.14 compared to $0.37 in the prior year.

Full Year Results

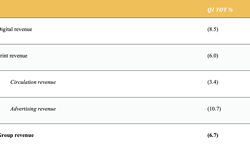

The Company reported fiscal 2023 full year total revenues of $9.88 billion, a 5% decrease compared to $10.39 billion in the prior year, including a $494 million, or 5%, negative impact from foreign currency fluctuations and the absence of the $110 million, or 1%, benefit from the additional week in the prior year. The decrease was driven by lower revenues at the Book Publishing segment primarily due to lower book sales and lower revenues at the Digital Real Estate Services segment primarily due to continued challenging housing market conditions in the U.S. and Australia. The decline was partially offset by growth at the Dow Jones segment, which includes the acquisitions of OPIS and Chemical Market Analytics (“CMA”), and at the Subscription Video Services and News Media segments on a constant currency basis. Adjusted Revenues decreased 2%.

Net income for the full year was $187 million, a 75% decrease compared to $760 million in the prior year. The decrease reflects lower Total Segment EBITDA, as discussed below, higher equity losses of affiliates mainly as a result of a non-cash write-down of REA Group’s investment in PropertyGuru of approximately $81 million, higher income tax expense driven by the absence of a $149 million tax benefit from an adjustment to valuation allowances in the prior year, lower Other, net and higher impairment and restructuring charges.

Total Segment EBITDA for the full year was $1.42 billion, a 15% decrease compared to $1.67 billion in the prior year primarily driven by lower revenues, as discussed above, an $80 million or 5% negative impact from foreign currency fluctuations, higher costs at the Dow Jones segment, higher sports programming costs and higher newsprint pricing. The results also include one-time costs related to the professional fees incurred by the Special Committee and the Company in connection with evaluating the proposal from the Murdoch Family Trust, as well as the fees related to the potential sale of Move. The decline was partially offset by cost savings across the businesses due to headcount and other cost reductions and lower costs at the Digital Real Estate Services segment due to lower broker commissions at REA Group and lower discretionary and employee costs at Move, as well as the absence of legal settlement costs at the Other segment. Adjusted Total Segment EBITDA decreased 15%.

Diluted net income per share attributable to News Corporation stockholders was $0.26 as compared to $1.05 in the prior year.

Adjusted diluted EPS were $0.49 compared to $1.20 in the prior year.

Click here for the full Earnings Release information.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.