As reported by Reach:

- Ongoing momentum in Customer Value Strategy is transforming our prospects

- Strong growth in registrations and digital revenue enabling increased investment in journalism, data and technology

- Digital revenue now 23% of business, up from just 15% in 2019

- Trading ahead of market expectations with strong digital performance and recovery in circulation sales

Financial Highlights

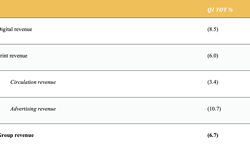

- Group Revenue LFL up 2.6%, with digital up 42.7% and print down 5.2%

- Adjusted operating profit of £68.9m up by 25.5%

- Adjusted operating profit margin 22.8% (H1’20: 18.9%)

- Adjusted operating cash flow of £82.6m (H1’20: £63.5m)

- Statutory profit and earnings impacted by property rationalisation and change in tax rate

- Interim dividend of 2.75p pence per share

Business and Strategic Highlights

- Sustained momentum of Customer Value Strategy supporting growth of digital revenues

- Ongoing investment in journalism and expansion of regional network to all counties of England and Wales

- Registrations now at 6.7m c150% greater than a year ago; confident of achieving 10m by the end of 2022

- Reach ID and investment in data capabilities supporting delivery of more targeted campaigns

- Strong start to commercialisation of ‘plus’ products; c50 campaigns run with significant uplift in consumer response

- Strong cash generation and balance sheet supports pensions, shareholder returns and investment optionality

- Increasing focus on wellbeing and culture; new diversity & inclusion plan across the organisation

Jim Mullen Chief Executive Officer: “Reach is transforming its prospects and with strong momentum in the Customer Value Strategy we now have a clear pathway to sustainable growth. Our people continue to deliver on our core purpose as champions, campaigners and changemakers. Award-winning national and local journalism is delivering consistently higher audience engagement, supported by increased customer insight. As a result, we have been able to increase investment in journalism and the applied data technology that is key to us achieving our ambition of doubling digital growth over the medium term. The business remains strongly cash generative and is committed to delivering growth for the benefit of all stakeholders.”

Results Overview

- Revenue of £302.3m grew by 2.6% LFL with digital growth of 42.7% and print declining by 5.2%

- Strong progress in delivery of Customer Value Strategy; increased investment underpins growth agenda

- Adjusted operating profit margin up 390 bps supported by efficiencies from prior year transformation programme

- Adjusted operating cash flow of £82.6m, an increase of £19.1m

- Net cash of £54.7m up £12.7m on FY20 closing position (£42.0m)

Revenue

- Year on year revenue growth reflects strong digital performance and softer comparatives during Q2 as we annualised the first COVID lockdown which began towards the end of March 2020

- Digital revenue of £68.8m grew 42.7%, with growth on a two-year basis up by 41.4% (H2’20 equivalent 39.8%)

- Print revenue £232.4m down 5.2%; circulation £160.0m down by 5.1%, both grew during Q2

- On a two-year basis, print and circulation down 23.9% and 16.0% respectively, consistent with H2’20 two-year rate

Profit

- Adjusted operating profit of £68.9m up £14.0m or 25.5% (H1’20: £54.9m)

- Adjusted operating costs of £234.9m (H1’20 £236.2m) with savings from 2020 transformation programme, in-part offset by increased investment and the annualisation of one-offs

- Statutory numbers impacted by property rationalisation charge following decision to exit a number of properties and the future change in the UK rate of corporation tax which affects the value of deferred tax liabilities.

Cash & Balance Sheet

- Adjusted operating cash flow of £82.6m represents cash conversion of 105%, driven by positive working capital inflow which is expected to substantially reverse during H2

- Net cash increased by £12.7m to £54.7m from £42.0m at the prior year-end

Dividend

- Interim dividend 2.75p; 4.6% greater than value of non-cash bonus issue of shares issued in lieu of interim last year

- Board recognises importance of growing dividends for shareholders, while also investing to grow the business and meeting pension funding requirements; expect to continue to pay dividends in line with Group free cash position

Outlook and Current Trading

While macro uncertainty remains, the business is well placed to progress further against our strategic objectives and is trading ahead of full year expectations. Trading during H1, specifically Q2, benefited from relatively soft comparatives due to the impact of the first UK lockdown during spring last year. This benefit will unwind during H2 as we begin to annualise a more normal pattern of trading. Despite this, we expect underlying momentum will continue, in particular the improvement we’re seeing in print circulation and growth in digital revenues, which has also been supported by the broader sector shift to online. Efficiencies, driven by last year’s transformation programme, will continue to support increased digital investment, further expansion of our profit margin and a strong cash position.

You can read the full report here.

Keep up-to-date with publishing news: sign up here for InPubWeekly, our free weekly e-newsletter.