According to Trinity Mirror:

The Board remains confident that performance for the year will be in line with expectations.

We have made good progress against our strategic initiatives and the business continues to deliver strong cash flows supported by structural cost savings of £20 million for the year which is £5 million ahead of our initial target. Net debt at the end of the third quarter fell by £3 million to £19 million and this is after paying the interim dividend of £6 million in September 2017.

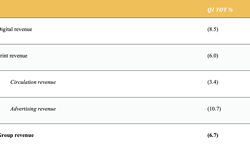

Group revenue on a like for like basis fell by 8% in the third quarter, an improvement on the 9% decline in the first half. We are experiencing improving trends in nationally sourced print advertising revenues, though local advertising, particularly classified remain challenging and volatile.

Publishing revenue fell by 9% with print declining by 10% and digital growing by 4%. Publishing print advertising and circulation revenue fell by 16% and 7% respectively. We delivered continued growth in digital display and transactional revenue of 14%, but classified digital revenues, which are substantially jointly sold with print, remained under pressure.

£10 million share buyback

Since announcing our £10 million share buyback programme in August 2016, the Group has acquired 8.9 million shares for £9.0 million and has paid £7.5 million to the pension schemes relating to the share buyback programme.

Update on discussions with Northern & Shell

Further to the announcement made on 8 September 2017, the Group continues to make progress on discussions to acquire 100% of the publishing assets of Northern & Shell. Further updates will be made when appropriate.