According to Trinity Mirror:

Outlook

The trading environment has, as anticipated, remained challenging for print advertising during the period. We continue to make progress against our strategy and at this stage, the Board anticipates performance for the year to be in line with market expectations.

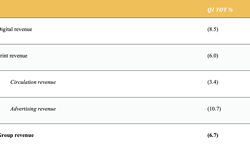

Revenue trends

Group revenue fell by 16% over the period. On a like for like basis Group revenue fell by 9% which is in line with the trends experienced in the first two months of the year.

Within this, Publishing revenue fell by 9% on a like for like basis, with print declining by 12% and digital growing by 6%. Publishing print advertising revenues fell by 19% and circulation revenues fell by 6%.

We continue to grow our digital audience with digital display and transactional revenue growing by 19%. Digital classified advertising, which is predominantly upsold from print, remains challenging and fell by 24%.

£10 million share buyback

Since August 2016, the Group has acquired 5.6 million shares for £5.8 million and has paid £7.5 million to the pension schemes relating to the share buyback programme.

Simon Fox, Chief Executive, commented: "Whilst the trading environment for print remains challenging we continue to make progress on our strategic objectives of Grow, Build and Protect. I am particularly pleased that we continue to see good growth in digital display and transactional revenue and tightly manage costs which gives confidence in our performance for the year."