All the feedback we are getting from the industry confirms that each media brand is finding (and then flexing constantly) its own, specific business model, that fits its own market and audience. This is based on finding as many monetisation points as possible. And refocusing on yields and engagement rather than scale and profile: going for profit rather than volume.

The bigger context

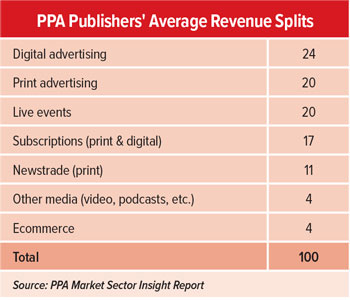

Last year’s ‘PPA Market Sector Insight Report’ gave an overview of the major industry revenue sources, as they stood at the start of 2023. Looking across the total PPA membership, the revenue profiles varied wildly from company to company and from brand to brand. Yet this was the topline view then…

- Digital advertising held the largest share, although this continues under great pressure.

- Print advertising was close behind, but is declining rapidly.

- Live events continued their rebound from the pandemic shut-down.

- Subs were growing in importance, but are still heavily print-skewed, especially in B2C.

- The newstrade, although declining and under increasing threats, still accounted for 11% of industry revenues.

- Developing revenue streams (‘Other Media’ and ‘Ecommerce’) were still relatively small and still have not yet gained real traction in terms of their current scale, despite their long-term potential.

- Print is still a major platform. 91% of PPA members publish a printed magazine and print related revenues account for 48% of the total.

Tracking the hot revenue sources

The more recent mediafuturesPULSE digs deeper to show an even more complex picture. We polled respondents as to where they saw future revenue growth coming from over the next twelve months.

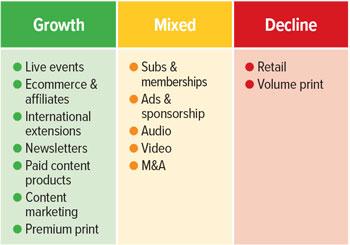

The leading driver of growth is a constant flow of new products and services. This is often based on flexing the old business models, where a number are in transition and where the changes can range from minor tweaks to radical restructuring. The responses showed that there are three clear segments of revenue:

1. Clear growth

- Live events (albeit in a range of formats and with varying business models post-pandemic) is the standout revenue booster in both Consumer and B2B.

- Close behind are Ecommerce / affiliate activity and growth into the international arena, with USA as a real focus for many.

- Leveraging content through new products, tools and services is a constant theme, as is sponsored content. Newsletters are key and a growing element of the content packages.

- Premium print (high quality / high price / low volume) still has a place in many operations.

Whilst digital platforms remain the future, there are two major provisos: digital growth is slowing and the margins remain thin.

2. Mixed performance

Areas where the publisher experience is a mix of growth and decline are:

- Subscriptions. Whilst this is a strong and strategically important revenue stream for many companies, a number report that rising acquisition costs and sliding renewal rates are not delivering the growth that had been hoped for. In addition, true “memberships” are difficult and costly to set up. Another key issue is the right-pricing of subs products and services, where there is a great deal of experimentation taking place, as publishers test how far they can push their prices.

- Ad and sponsorship revenues are very varied from market to market: coming back in some, whilst dying in others.

- Audio and Video are both high profile and engaging, but still need to be monetised in a more structured way.

- M&A activity is significantly affecting the turnover trends for a number of companies, both up and down. It has also sparked some unexpected blips for some businesses: eg. increasing subscription attrition rates, culture mismatches, clashing internal processes, multiple tech stacks, etc.

3. Clear decline

Both retail and volume print are in long-term decline, but the publisher approach ranges from trying to “extend the runway” creatively, through to actively accelerating the decline and forcing a fast exit into digital and subscriptions.

The big background issues

There are some key issues sitting behind all these figures.

The first is the danger of over-diversification. The PPA research shows that 86% of its members already operate across five or more platforms. Yet doing too many things at once can undermine quality, consistency and brand image. It can also stretch and confuse staff to breaking point. There is a real requirement to be ruthless about what needs to be done as opposed to what would be nice to do.

The second is poorly-executed diversification. There are a number of (confidentially shared) examples in mediafuturesPULSE of where poor project management undermined a really sensible strategy. More public has been Spotify’s wild diversification into podcasting: all very slick, with some great content, but a financial disaster when looking at the modest return on a massive investment.

The third issue is stretch-diversification into an area where the company has limited or no experience. Sometimes, this can be the lateral brainwave that unlocks a new and productive direction. Yet, often, it can undermine the established, core activities and absorb too much money and corporate headspace. Netflix’s foray into virtual gaming may well turn out to be an example of something that made sense on strategy weekend, but which falls apart in the real world.

Broadening the revenue base is what every media company wants (and needs) to do, but it’s not quite as easy as it sounds. However, the industry is rising to the challenge with real creativity and conviction.

mediafutures is an annual benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing. Now into its 16th year, it covers Consumer Media, B2B, Live Events & Exhibitions, News Media and Customer Media. It maps the key drivers and metrics that are transforming the shape and direction of the whole media business. mediafuturesPULSE is a new, quarterly survey tracking the short-term shifts in a rapidly changing industry.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.