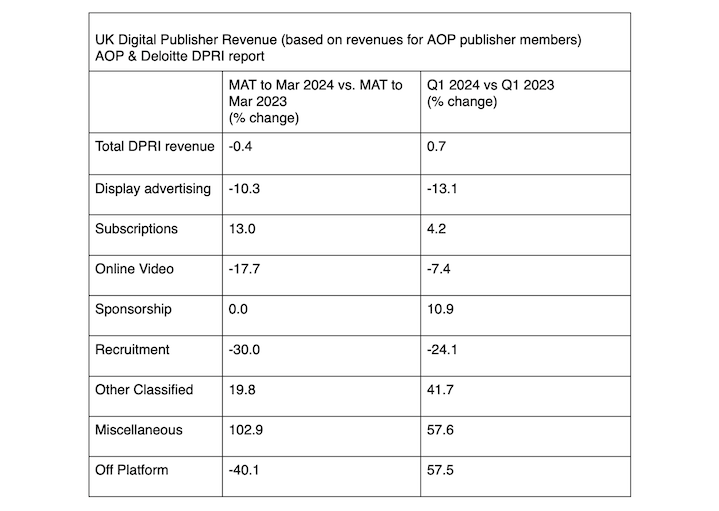

The latest Digital Publishers’ Revenue Index (DPRI) from the Association of Online Publishers (AOP) and Deloitte reveals a continuing shift in the composition of digital revenues, with subscription, audio, and sponsorship all growing, while revenue from display continues to diminish. Overall, digital revenue for Q1 2024 saw a small increase of 0.7% compared to Q1 2023.

Though display formats remain the largest category by volume, after more than a year of consistent decline, the gap is closing with subscription revenue. Comparing Q1 2024 to Q1 2023, display revenue decreased by 13.1% to a total of £53.5 million, while subscriptions increased by 4.2% to £47.1 million — or 35% of total revenue versus 31%.

Digital audio and sponsorship revenues also saw Year-on-Year (YoY) growth at 13.8% and 10.9% respectively, while video declined by 7.4%. “Miscellaneous” revenues, which include first-party data monetisation, also saw significant growth of 57.6%.

An interesting trend emerges when reviewing the Moving Annual Target (MAT) figures up to March 2024, where audio revenue shows a significant increase of 131.4%, far higher than the YoY comparison from Q1 2023 and Q1 2024. This suggests more publishers offered audio as the year progressed, or that they’ve been able to draw additional value from the offering over time.

An ongoing trend is the shift to multi-platform revenues away from desktop-only or mobile-specific revenues. In Q1 2024, multi-platform revenues grew by 11.3% compared to Q1 2023, while desktop dropped by 22.6% and mobile dropped by 32.6%, with the £12.4 million YoY increase in multi-platform revenue more than offsetting the combined £11.5 million YoY reduction in desktop and mobile revenues.

All respondents (100%) expect to see advertising revenue growth over the next 12 months, compared to the 75% who responded as such in Q1 2023. Those who expect non-advertising revenue growth fell from 100% to 50%, while all respondents believe acquisitions and cost reductions will be sources of growth. Overall, 43% of participants reported positive revenue growth in Q1 2024, down from 50% in the prior quarter.

Andy Cowen, lead partner for telecommunications, media and entertainment at Deloitte, said: “It’s encouraging to see a year-on-year increase in overall digital revenues – albeit less than a one percentage point increase. However, as publishers continue to focus on new products, this trend appears to be bearing fruit with both subscriptions and sponsorship revenues climbing this year. These areas of growth are helping to offset any decline in other areas, particularly in display formats and online video.”

Richard Reeves, managing director at AOP, commented: “Display advertising and subscriptions are closing in on taking an equal share of digital publishers’ revenue, which is welcome news for an industry that is too often buffeted by the storms in ad-land. Meanwhile, though still a modest share of total revenue, audio’s ongoing growth is fascinating to track. Should this trend continue, we may see audio revenue overtake video, which I doubt many would have predicted this time last year.”