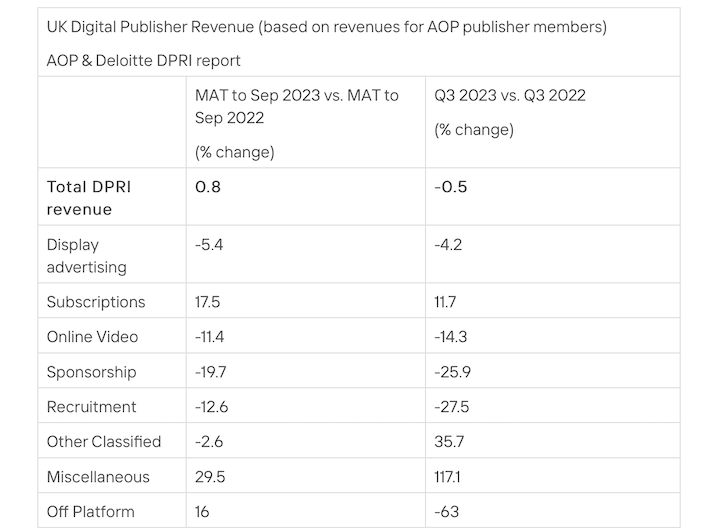

The latest Digital Publishers’ Revenue Index (DPRI) from the Association of Online Publishers (AOP) and Deloitte was released last week and reveals 58% of respondents reported growth year-on-year (YoY), though overall digital revenue for Q3 2023 was down by -0.5% from Q3 2022, for a total of £153 million.

After growth of just 0.3% in Q2 2023, digital publisher revenues in Q3 remain flat, indicative of the wider contraction in advertising spend. Notable drops occurred across display formats (-4.2%), video (-14.3%), and sponsorships (-25.9%). These losses were largely compensated by the ongoing growth in subscription revenues (11.7%), a category that has been performing well for more than a year.

Digital audio returned the most significant growth, up by 500% in Q3 2023 versus Q3 2022 though at a total of £3 million, it remains a relatively minor revenue stream. However, based on the increase from the £1.9 million generated by digital audio in Q2 2023, this category is one to watch. The “miscellaneous” category — which includes data monetisation — was also a growth hotspot at 117.1%, up to a total of £8.9 million.

Consistent with trends reported in previous quarters, multi-platform revenues are growing (10.5%) while mobile and desktop-specific revenues contract (-30% and -16.7%). Comparing multi-platform to platform-specific revenues reveals the drop in display revenue was driven entirely by the latter. Display revenues actually grew in the multi-platform category by 3.9%, while mobile and desktop saw falls of -4.7% and -18.1% respectively — the fall in video revenues, however, was consistent across all three. The outlier in video fortunes was the B2B category which, despite overall revenues falling by 5%, saw video revenues increase by 50%.

When asked about future business priorities for the next 12 months, members returned remarkably similar responses as Q3 2022, with new products and services cited as a priority by all respondents (100%), increased cashflow by 75% of respondents, non-advertising revenue by 66%, cost reductions by 50%, and acquisitions by 33%. Only advertising revenue growth diverted as a priority, dropping from 75% of respondents in Q2 2023 to 50% in Q3 2023.

Andy Cowen, lead partner for telecommunications, media and entertainment at Deloitte, said: “Despite a more subdued quarter for digital publishers, with a slight drop in growth year-on-year, there are still positive signs across sectors of the industry. Particularly encouraging are the green shoots of growth across digital audio which, although still a smaller revenue stream, has grown 500% year-on-year. This is a sign of ongoing diversification of revenue across the publishing industry and demonstrates consumer appetite for content across various platforms.”

Richard Reeves, managing director at AOP, commented: “Subscription revenues now account for almost a third of total publisher revenues, and by current trends, it could hit this milestone within a couple of quarters. Decoupling revenues from the ups and downs of advertising spend can provide a greater degree of financial security, though this cannot be a solution for all properties.

“Though overall revenues are flat, an increasing proportion of respondents reported year-on-year growth, at 58% in Q3, up from 50% in Q2 and 36% in Q1. This shows us there are extreme gaps in fortunes between individual publishers, and I urge a spirit of collaboration so that we can learn what is working for some and apply their success to the rest.”