According to Johnston Press:

The Group continues to make good progress with its strategic initiatives, and the Board of Johnston Press remains confident that trading for the full year will be in line with its expectations.

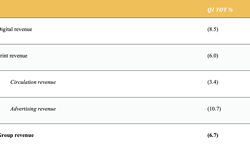

Total Group revenue, excluding classifieds, was flat in the third quarter, and including classifieds was down 7%, a 1 percentage point improvement on the second quarter.

Digital revenue saw continued growth, up 16% in the quarter (excluding classifieds), a 3 percentage point improvement on the second quarter. Print advertising (excluding classified) was down 8%, with print classified advertising remaining very challenging. Circulation revenues were down 4% in the quarter. Contract print revenues were up 8%.

The i newspaper continues to perform very well, with total like-for-like revenues increasing 17% in the quarter (with print advertising up 14% year on year), while the newly re-launched i weekend has seen its average circulation volume increase by 15,000 in its first 3 weeks.

Other successful Saturday relaunches during the period include the Lancashire Post and the (Ulster) News Letter, both of which delivered a 3% increase on their base sale.

We achieved record web traffic during Q3, led by the Yorkshire Evening Post growing 64% year on year. We have also seen significant growth in digital native advertising in Q3 with growth of 190% over Q2.

We have completed our strategic sales change programme, moving some 60% of our advertising accounts into tele-sales, serviced from our Sheffield-based Media Sales Centre, which will now be moving to new offices to accommodate this growth part of our business.

Digital display advertising growth of 16% has been driven through the use of user data to target customers and grow advertising yields. More than 25% of local campaigns in Q3 had data-led targeting, resulting in an increase in yield of up to 22%. That user data is being bolstered by new initiatives launched during Q3 to register users on our sites and build first-party data, to increase page yields.

Highlighting our shift to digital sales locally, The Scotsman in Q3 generated a 35% increase in total local advertising year on year, driven by 47% of local display revenue now coming from digital products.

Strategic review of financing options

On 29 March 2017, the Board announced that it had commenced a strategic review to assess the financing options available to the Group in relation to its £220 million 8.625% senior secured notes which become due for repayment on 1 June 2019.

During a period of initial consultations in April and May 2017, certain of the Group's largest shareholders and bondholders expressed views regarding refinancing options and their broad parameters. Following these initial consultations, the Board engaged in preliminary discussions with the Trustees of the Johnston Press Pension Plan (the "Pension Trustees") in relation to potential amendments to the pension scheme. Discussions on a framework presented to the Pension Trustees progressed constructively over the summer and on 19 September 2017 resulted in a draft set of proposed amendments to the pension scheme which could be effected in the event of a wider capital reorganisation.

On 10 October 2017, the Board announced that it was approaching its largest bondholders regarding the formation of an ad hoc Committee of bondholders (the "Bondholder Committee") to consider in greater detail certain potential amendments to the Group's capital structure, and that committee has now been formed. The main objectives of these proposed amendments to the capital structure, combined with the proposed amendments to the pension scheme, are to (i) achieve a sustainable level of debt within the Group to enable it to refinance its debt in the future, and (ii) materially reduce or eliminate the pension scheme deficit by 2021, whilst preserving the pension scheme members' benefits.

All of these proposals remain subject to negotiation and the consent of relevant stakeholders, and there can be no certainty that a formal proposal will be forthcoming.

The Board anticipates discussions with the Bondholder Committee to progress over the coming weeks with the aim of further updating the market in due course.

Ashley Highfield, CEO of Johnston Press, said, "Our key strategic priorities of continuing the success of the i newspaper and growing digital revenues have both shown strong gains during the period. It is significant that The Scotsman saw strong year on year advertising growth in Q3, with almost half of that coming from digital, driven by both audience growth and increased monetisation from data-driven targeted advertising.

A significant amount of work is being done on the strategic review of financing options and we are pleased with progress to date."