What can UK publishers learn from their continental cousins? We usually look across the Atlantic for inspiration in business models and revenue diversification, no doubt due to the language. But we have literally dozens of test markets just across the Channel, where inventive European media businesses are experimenting and growing.

Collaborating with Media Makers Meet (Mx3), an event series for media innovators in Europe, I have researched dozens of European publishers, both B2B and specialist consumer, exploring how they have driven change in their media businesses. The full report will be published (free to read) in early summer. But here is a sneak preview of the trends identified so far and how they can apply to UK publishers. Plus some mini-case studies of inspirational innovation.

Five European case studies

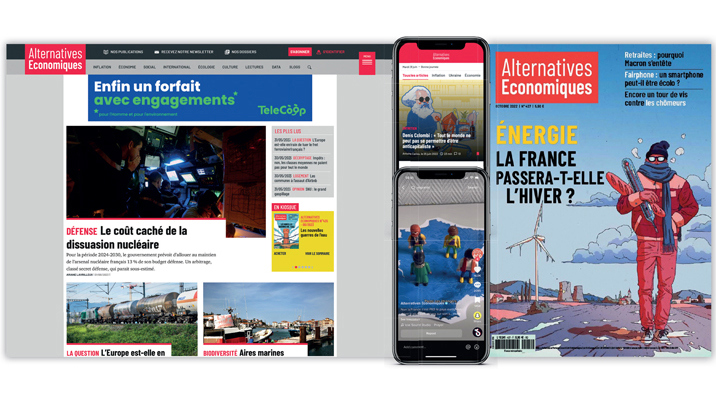

- Alternatives Economiques: This independent French business and economics magazine was launched in 1980. Since 2019, it has focused on digital subscriptions, tripling numbers to 21k and achieving profitability with very little advertising revenue. More recently, it has added a registration wall, which is gathering 5,000 new accounts a month, to feed into subscriptions. Alt Eco are keen to target a younger demographic, and have built up a 100k following on TikTok. They plan to create a student subscription. They have also developed a mobile app to encourage subscriber engagement. Popular features so far include bookmarks, search and including TikTok videos. (Website: www.alternatives-economiques.fr | Staff: 40 | Location: France)

- Wolves Summit: Starting as a live event for East European start-ups and investors in Poland, this entrepreneurial group has tripled its revenue since 2020. Their events have expanded to Vienna, London, Budapest and Berlin, but this year, half their revenue will come from inventive ways to use their expertise. Their digital event agency advises other organisers on running effective hybrid events. But the really smart move is developing partnerships and collaborations with corporates and government agencies from SE Asia and Middle East to advise on the East European start-up scene and creating accelerators, leveraging their market knowledge for a new group of customers. (Website: www.wolvessummit.com | Staff: 15 | Location: Poland)

- Spitta: An established dental magazine publisher has expanded into providing professional education and practice management software for a community of 30,000 German dentists. 90% of their educational programmes are delivered online. They have set up an in-house innovation team that identifies new SaaS products, researches the audience proposition, develops them in-house and then markets across all their media. In 2013, 5% of revenues were digital, by 2023, 50% will be digital or from new business models. The ambition is to reach 70-80% digital in a few years. Profits are now over four times higher than in 2013. (Website: www.spitta.de | Staff: 100 | Location: Germany)

- Landwirtschaftsverlag: A long established agricultural publisher with over 50 titles. For their monthly print farming publication, Top Agrar, they created a separate digital subscription to a digital news service. They set up an in-house innovation team which has looked broadly at opportunities for new digital platforms. Traktorpool is an online marketplace for second hand farm machinery. Bullship is a livestock trading platform. Waldnews is a new digital content site for forest owners. And landverliebt.de is a dating site for countryside lovers. LV have also launched a series of events and webinars – connecting farmers with experts and regulators, building on their deep relationships with readers. (Website: www.lv.de | Staff: 900 | Location: Germany)

- Dennik N: An independent news publisher based in Slovakia, Dennik N now has 65,000 active subscribers, 98% digital only. It has 120 staff in Slovakia, many of whom are shareholders in the business. In recent years, they have launched a sister paper in Prague and also a Hungarian language edition. From the start, they made their monetisation software (REMP) open source and it is now used by dozens of other publishers, including direct competitors in Slovakia. They provide educational materials in both print and digital to schools, reaching 400k students. This was an altruistic project to start with, but many subscribers have made donations, plus there are some corporate funders. Next focus is paid audio – developing a monetisation system for publishers to charge for audio content. (Website: www.dennikn.sk | Staff: 120 | Location: Slovakia)

Best practice for UK publishers

What lessons can UK publishers learn from these innovative European media businesses? Success starts with deeply knowing your audience, and understanding the secondary audiences you can reach. Then you must explore content innovation within core brands and explore new product development. Events and online communities assist in bringing your audience together. There are more opportunities to develop new marketing solutions for advertising clients. And digital subscriptions propositions are a core route to reaching new audiences. Finally, technology strategy is key, whether that be installing third party solutions or developing in-house systems, often in collaboration with other media owners.

1. Audience expansion

First, know how your market works. Some European publishers have mapped their entire ecosystem in order to identify new customer segments. Look beyond your core audience to their customers, investors and suppliers.

Then identify your secondary audiences, which could include advisors, regulators or commercial interests. How can you support their understanding and apply your editorial insights?

Investigate how media brands can appeal to younger demographic groups. In B2B markets, focus on the needs of early career executives. Alt Eco is using TikTok to reach new groups. Dennik N provide educational materials for schools. Other publishers are discovering that the highest take-up of digital-only subs propositions is among younger groups.

Translate to new countries / languages. Many European publishers have translated content or successful business models to neighbouring countries. Or identified a new language group within an existing country.

2. Content innovation

Many publishers are shifting towards audio and video content, especially when targeting younger audiences. More are offering audio as a major component of their paid subscriptions. Some have set up in-house studios to produce audio and video.

Create segmented newsletters, either by identifying sub-groups within your audience, or by using audience behaviour analytics to develop personalisation based on actual reading patterns and preferred topics.

Consider moving into professional development or training. Multiple B2B publishers have established in-person and online courses for specific audience groups. Online trackers which allow learners to monitor their progress are popular. Some publishers have collaborated with business schools to create tailored courses. Frequently, the professional development proposition is a core element of subscription or membership.

Test mobile apps to build reader engagement, allowing readers to select the content format they prefer or make it easier to bookmark and retrieve favourite items.

3. Product innovation

Build tools that support publishers – and make them available to other media owners. Dennik N has made its monetisation tools available to its competitors. Others have developed tools for journalists that are now available on a SaaS basis.

Develop SaaS workflow tools for your core audience. From deep understanding of customers, you can spot data or workflow problems you can solve for them. For example, Spitta has built practice management software for dentists.

Launch digital marketplaces that solve customer problems. LV has created livestock trading platform Bullship and farm machinery marketplace Traktorpool.

Test emerging markets with low-cost digital brands. LV has launched a site for woodland owners.

Explore partnerships and consultancy, applying your market insight and skills. Wolves work with corporates on their start-up incubators.

Set up in-house innovation teams or ideas labs, who can focus on evaluating, researching and developing new products.

4. Events and community innovation

Integrate event content into communities, to continue the discussion post event and allow members to suggest topic ideas to event producers.

Experiment with digital all year round content hubs to complement in-person events.

Launch industry awards to strengthen connections. Engage contributors or members as advocates to recruit new members.

5. Innovation in marketing solutions

Create a content agency to advise advertising clients on how best to communicate with your audience.

Add personalisation to advertising propositions: tracking audience behaviour to create contextual advertising.

Develop ‘intent data’ to track content engagement patterns and allow advertisers to retarget prospective customers who have read relevant content.

6. Digital subscriptions

Convert print subs to digital or launch a digital subs proposition alongside print subs to reach a broader, younger or international audience.

Add free registration to digital content to collect first party data. This has helped publishers reduce print frequency or even stop print altogether and build a marketing funnel for paid subscriptions.

Bundle subscriptions with community and valued features, such as audio, events and other digital benefits to increase ARPU.

Use referrals and ambassadors to drive membership or subscription growth via word of mouth.

Test corporate subscriptions. Some publishers have dramatically increased membership rates by focusing on larger corporates.

7. Tech strategies

One approach is in-house development. Better speed and flexibility can outweigh the recruitment and management challenge. Spitta has developed SaaS products alongside their publications with an in-house dev team. Other publishers have built monetisation systems, or intent data services, using in-house developers.

An alternative is upgrading your third party tech stack. This has worked well for one publisher who now has universal registration and high quality audience analytics which support both editorial developments and contextual advertising.

Conclusion

Look beyond your own borders and other English language publishers for inspiration in developing business models and diversifying revenues: let Google translate be your friend! The smaller linguistic markets in many continental European countries have encouraged publishers to look to adjacent territories, or to fully exploit all the opportunities in their own ecosystem.

The full report can be downloaded here.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.