Simple answers to simple questions. That’s what we’d all like, probably in every aspect of our lives in these turbulent and unpredictable times. Yet media company CEOs want that more than anyone else. What they normally get are complicated answers to their simple questions. With so many options and opportunities, the critical decision is how to prioritise and not try to do too much at once.

The mediafutures project collects a mass of confidential benchmarking data from the pool of media companies who have taken part over the last few years. It produces some deep and rich insights into the operations of each company, as well as the longer-term trends over time, which in turn link into key industry benchmarks.

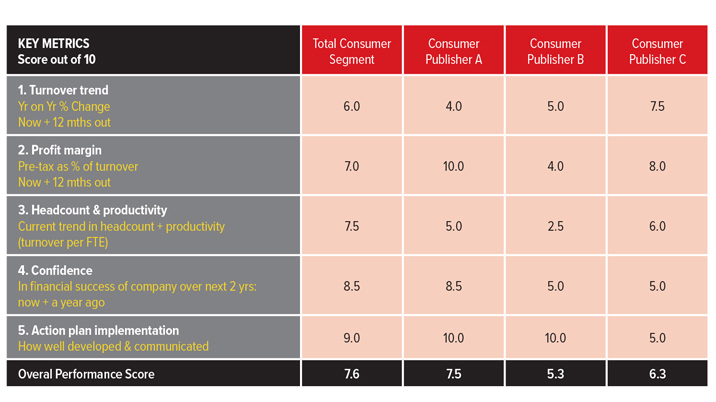

The table above gives a taste of a new route into this pool of data: the mediafuturesPULSE Scorecard. The process takes five key metrics at the core of every media company, whatever its market or revenue model.

- Total Consumer Segment: These are the average scores across all the consumer media companies in the latest wave of mediafutures: the survey also covers B2B, live events specialists, national and regional newspapers, membership organisations and customer publishers. Consumer media is actually lagging well behind B2B in terms of the first two metrics (turnover trend and profitability), but matches more closely in the other three areas.

- Consumer Publisher A is a major player. Its turnover is dropping (hence its low score), but its profit margins are market-leading. Its headcount is static and its staff productivity levels (turnover per FTE) are very middling: it needs to focus more on streamlining its processes and driving more efficiencies. Yet the confidence within the company is strong and growing: it has a plan and knows what it is doing. It is also actioning and communicating that plan well within the company. The majority of the companies in mediafutures do have a vision of where they want to be, even though getting there may be more challenging.

- Consumer Publisher B is another significant player, but with a much smaller portfolio of monolithic brands: it actually has too many eggs loaded into too few baskets, which makes it a high-risk operation to manage. Its turnover trend is slightly stronger than Publisher A, but still well behind the rest of the market. Its profits are currently solid, but it is about to dive into loss in the next twelve months, as it invests in a number of areas, notably tech stacks and a dive deeper into the digital delivery of content. At the same time, it is reducing headcount, as its current productivity levels are low and need significant improvement. Confidence levels are also low, as there is considerable nervousness about whether all the changes taking place will deliver what is needed. Yet at the same time, it has a clear and carefully thought-through plan, which it is putting in place and communicating well through the company, but with fingers (and toes) crossed.

- Consumer Publisher C is a very different kettle of fish. It is a small, single-brand, owner-operator company. It is still very print-focused and is leveraging its legacy assets very effectively in its niche vertical. This is all feeding through into strong turnover and profitability figures. With a small, stable, tightly-run organisation, its headcount and productivity figures look solid, although it simply does not have the scale to drive the productivity figures that some of the larger publishers are achieving. Yet the owner knows that its digital competence is low and recognises that there is no clear plan in place (or the money to drive rapid tech investment and the necessary staff skills upgrades) to be ready for the future – hence the low confidence and action plan implementation scores.

Clearly, this kind of scorecarding is just the first step in running a full health check. This will need to be undertaken at individual brand / product level. It also requires a deeper dive into profitability, where many companies muddy the figures with cross-charges and cost allocations that are often illogical or inconsistently applied from year to year. Yet getting the topline company picture is an essential start-point.

The mediafutures project has a number of other, more detailed metrics that do not go into the initial scorecard, but which include:

- Change Assets: Seven key factors that equip the organisation to change and innovate. Tech stacks and fast staff-upskilling remain the two weakest areas.

- The Action Plan: What are the main priorities in balancing investment versus cost-cutting?

- Revenue Priorities: What are the hot revenue streams to focus on?

And lots more besides.

Every media company should be doing metric monitoring on a regular basis, although it is clear from our work that many are not. Or, they do it inconsistently (changing the key metrics or tracking different measures on different brands) or without external benchmarks (not looking outside their own company or sector). And occasionally, naughty senior management deliberately change the metrics to drive the troops on to greater heights – as if the troops don’t know what is going on!

Simple answers to simple questions? If only! Yet there is a midpoint between seat-of-the pants guesses and over-engineered plans that have too many metrics. Getting that balance right marks out the winners from the losers.

The next phase of mediafutures fieldwork is about to take place…

mediafutures is an annual benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing. mediafuturesPULSE is a new, quarterly survey tracking the short-term shifts in a rapidly changing industry.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.