We are all, quite understandably, obsessed about peering into the future. Yet this has never been as difficult as it is currently. As a client recently noted: “It’s like riding a roller coaster through thick fog”.

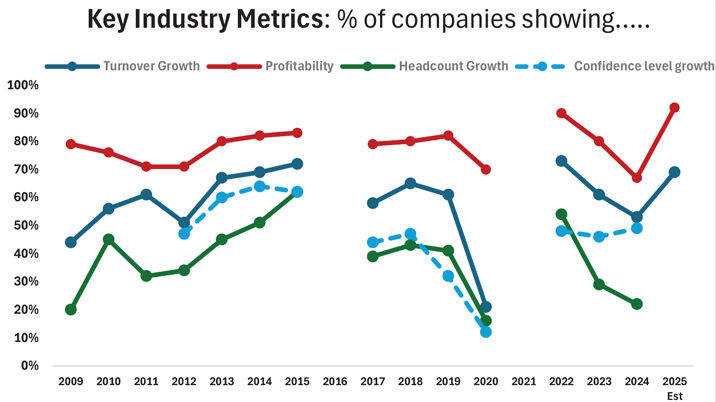

One benefit of having a survey like mediafutures is that it goes back sixteen years and it is possible to take a long backward view of our industry and to see whether that has anything to guide or reassure us now. Take a look at the above graph which tracks four key metrics back to 2009.

Let’s start with the long-term movements. Whilst there are subtle differences between each metric from year to year, there is a common, broad pattern.

- 2011/12 was a wobble period when most of the metrics were sliding after two years of a positive upward spurt.

- This was followed by another period of strong growth, before...

- ...a serious crisis year in 2016. That year was such a chaotic mess that we didn’t have a statistically valid sample to publish hard data. Yet what we saw and heard, much of it anecdotally, confirmed that this year really tested the sectors that mediafutures covers.

- The 2017 bounce-back came, but was already cooling down in 2019 before Covid hit and slammed all the metrics down into the lockdown crisis year of 2020.

- 2021 was another volatile “data gap” year before the 2022 bounce-back. Yet since then, there has been another cooling-off period in 2023/24, but more pronounced than last time in the business cycle.

Digging into the detail

- Turnover growth. The turnover growth line shows the percentage of companies reporting year-on-year growth in their sales. This is obviously very sensitive to the immediate trading environment. The number of companies reporting growth in bounce-back 2022 was a record-breaking 73%. This cooled to 61% last year and then slid again to 53% currently, but with a real belief in a strong 2025 (back up to 69%). This may be a bit of wishful thinking, but it is what is going into publishers’ own budgets for next year and it is also based on many companies feeling that they have made real progress on their strategies, which will all come to fruition in 2025 in better market conditions.

- Profitability. This line shows the percentage of companies in profit in the reporting year. This is both more stable and higher than turnover, as most companies flex their cost base to follow the turnover trend. There is the same cooling-and-recovery pattern as with turnover, if slightly less volatile.

- Headcount growth. This metric shows the percentage of companies increasing headcount in the reporting year. This is the most sensitive (and usually leading) indicator. Yet the simple staff numbers gloss over a very complex and challenging range of issues (to be covered in a future article).

- Confidence level growth. This shows the percentage of respondents stating that they feel more confident about the financial future of their companies over the next two years. This has been holding up well over the last three years — a very positive sign that the industry is ready for whatever happens next.

What can we learn from the past?

The first point is that we should have more confidence about the resilience, creativity and agility of our industry: our ability to bounce-back out of a crisis. Even though the current challenges are uniquely challenging and coming at us with unprecedented speed, we’ve faced tough times before and have survived.

Linked to that, we also need to remember the lessons of the past. The downside of getting rid of some of the older executives in favour of younger, more dynamic (and cheaper!) young heads (resulting in what we call “staff greening”) is that there is now very little corporate memory of the longer-term past. We can still learn from the past, often how not to do things. There is a great deal of reinventing digital wheels to solve recurring issues.

What is also very clear from the latest wave of mediafutures is that the views of many senior executives about present performance have been shaped by their expectations of the strength of the post-pandemic bounce-back. We simply haven’t got back to where we were, either financially or in the operational shape of our companies.

Behind all this lie a number of complex issues: mindfulness and mental health strategies to reduce burnout; pausing to celebrate success; working out how to share learnings across a diverse pool of staff who are churning more quickly than ever before; etc, etc.

So, we may not be able to get off the roller-coaster, but we are not as helpless and powerless as we may sometimes feel.

mediafutures is an ongoing benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing. Now in its 16th year, it maps the key drivers, metrics and issues that are transforming the shape and direction of the whole media business. mediafuturesPULSE is a new, more regular tracking survey of key industry performance metrics.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.