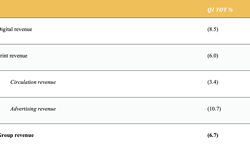

According to Trinity Mirror plc:

Financial Highlights:

• Resilient performance despite difficult trading environment, with one week less trading versus 2016

Strong management of the cost base limited the decline in adjusted operating profit to 9.4% or £6.5 million despite revenue falling by 14.6% or £54.7 million. Adjusted operating margin increased by 1.2 percentage points to 19.6%. Like for like revenue fell by 9.3% or £32.9 million.

• Continued growth in digital revenue

Like for like publishing digital revenue grew by 5.9% to £41.4 million with digital display and transactional revenue growing by 18.0%. This was partially offset by digital classified revenue falling by 23.9%.

• Structural cost savings target increased to £20 million

We delivered structural cost savings of £10 million in the period. These were ahead of target and we have increased our structural cost savings target for the year to £20 million, £5 million ahead of the £15 million target.

• Decline in pension deficit by £59.2 million

The IAS19 pension deficit fell by £59.2 million to £406.8 million (£336.1 million net of deferred tax). The Group paid £20.6 million into the defined benefit pension schemes in the period.

• Net debt reduced to £22.4 million and continued financial flexibility

Adjusted EBITDA of £72.9 million and reduction in net debt of £8.1 million to £22.4 million. The Group continues to have financial flexibility and during the period made the final payment of £68.3 million on the private placement loan notes utilising cash and a £30 million drawing on the £110 million bank facility.

• Interim dividend up 7.1% to 2.25 pence per share

We remain committed to our progressive dividend policy and the Board expects dividends to increase by at least 5% per annum. The interim dividend has been increased by 7.1% from 2.10 pence to 2.25 pence per share.

• Share buyback progressing

The Group acquired 4.2 million shares for £4.6 million during the period under the £10 million share buyback programme announced in August 2016 bringing the total amount purchased to 6.7 million shares for £6.9 million.

• Historical legal issues

As previously announced, the provision for dealing with historical legal issues has been increased by £7.5 million.

• Strategy and outlook

We continue to make progress with our strategy of growing digital display and transactional revenue whilst at the same time tightly managing our cost base to support profits and cash flow.

Although the trading environment remains challenging, at this stage, the Board expects full year adjusted results to be in line with expectations.

Commenting on the interim results for 2017, Simon Fox, Chief Executive, Trinity Mirror plc, said: “Whilst the trading environment for print in the first half was volatile, we remain on course to meet expectations for the year. I continue to anticipate that the second half will show improving revenue momentum as we benefit from initiatives implemented during the first half of the year.”