mediafuturesPULSE is a new service spinning out of Wessenden’s main mediafutures benchmarking project, which is now in its 15th year. It has been launched in response to numerous requests for a topline tracker that picks up the shorter-term trends in between the annual “state of the nation” surveys that dig deeply into the business models of a range of media companies.

The media business is changing so rapidly and is moving in so many different directions at the same time, that senior executives need a clearer steer on where the industry is headed and at what speed. They also want a better idea of how they are performing against their competitors.

The Big Picture Context

All the key economic indicators point to the fact that the UK is going through a challenging time economically – a “permacrisis” of constant change, stress and unpredictability. Yet the broad conclusions are that:

- This looks like an extended period of stagnation rather than deep and sudden recession. It is still painful, but is not “bust and boom”.

- The situation is very varied across business sectors and across consumer cohorts. Our economy is becoming more complex, fragmented and volatile.

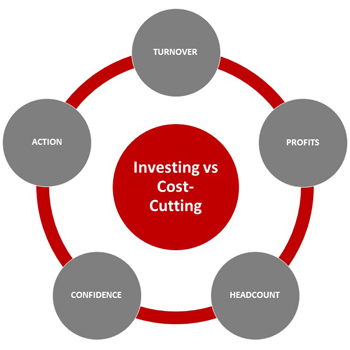

This situation is replicated in the media business itself and has been mapped by mediafutures for some years. The underlying evolution is towards digital media, but legacy activities are not always being replaced by the new platforms. Instead, they often run side-by-side, adapting and mutating, sometimes in surprising ways. This means that media business models can vary radically from brand to brand, never mind from company to company. The specific dynamics can also change rapidly through time. Yet a handful of key metrics sit behind every model. These are the five mediafuturesPULSE metrics:

1. Turnover growth

+3.8% YoY currently / +4.2% in 12 months’ time

Turnover growth has slowed down significantly since 2022. Yet there is still a big gap between B2B and Consumer Media, although this gap is closing, as B2B cools down and Consumer starts to accelerate slowly. In addition, there is little difference by the size of the company (a vibrant SME sector was a feature of the 2022 survey), as it looks like the larger companies are getting their act together.

2. Profitability

80% of companies in profit currently / 83% in 12 months

The number of companies in profit is still high, but is down on 2022. Where companies are profitable, margins are also down, but are still strong, averaging 10% – most operations have been cutting costs to track turnover trends. Here again, B2B is much stronger than Consumer. The majors are much more profitable than the smaller companies, as they streamline, restructure and leverage their scale.

3. Headcount & productivity

29% of companies increasing staff over next 12 months / 58% steady / 13% cutting back

The rate of topline headcount growth is much slower than in 2020, with Consumer showing much weaker figures than B2B. The biggest headcount cuts are coming, predictably, in the larger companies. Beneath the topline figures, there is significant churn and also stresses and unresolved issues. These are detailed in a recent article I wrote for InPublishing.

4. Confidence in financial success of the company over next two years

7.0 out of 10 / 46% more positive than a year ago

This “soft” metric is becoming increasingly important, as it reflects the corporate energy to keep going. The range of scores is very wide at the moment, from depressingly low 3s to (dangerously?) high 10s. The absolute number (7.0) is down on 2022, but the percentage of respondents who say they feel more positive than a year ago is steady at 46%. Generally, there are stronger scores among the larger companies.

5. Implementation of the action plan

83% have clear & active plans in place

The 83% figure is made up of 47% who have clear plans in place, where the strategy has been sold and communicated through the business, plus 36% who still have the internal “buy-in” process to go through. This leaves a vulnerable 17%, who are (1) still working on the plan, (2) know broadly what they want to do, but do not yet have a plan and (3) a small number who are completely overwhelmed by the scale of what they should be doing next and really do not know where to turn.

These five metrics then feed into some major judgement calls that every media business is making currently…

Balancing investing against cost-cutting

We asked participants how they were balancing investing in the business (where “investing” stretches across spending on marketing, research, tech stacks, journalism and content creation, staff headcount, staff training, etc) against actively taking cost out. There are three core groups:

- Investors (35%) are pumping more money into the business than the costs they are taking out. Typically, these companies are well on their strategic journey. Most have been through the pain of a major restructure and right-sizing; they are taking a long-term view, which includes an acceptance that there will be a short-term profit hit; and they are confident about the future.

- Prudent Balancers (42%) form the largest group, as they fund their investments by taking out cost.

- Cutters (23%) divide into (1) efficient, productive and lean operations, (2) people right-sizing before investing and (3) those who are desperately fighting to survive.

We then asked whether that balance was likely to be different in twelve months’ time. As a sign of the volatility of the whole industry, 54% are preparing to flip into a different approach:

- Positive Flippers (33%) are about to flip into investment.

- Steady State (46%) are holding to a consistent strategy: the largest group, but still a minority.

- Negative Flippers (21%) are preparing for the pain of right-sizing.

What does all this tell us?

The uncontrollable tides of permacrisis are becoming more unpredictable.

- The overarching economy, confidence levels and rising operating costs are affecting every business.

- There are media-specific issues such as print and paper prices, volatile social media traffic, disappointing digital advertising volumes and yields, the trend from reading into short-form video, etc. In addition, the impact of AI on media is multi-faceted, a mix of pros and cons and very unpredictable, with a lurking existential threat behind it all.

Relatively strong metrics in testing times. Despite all the stresses and challenges, the industry is showing a remarkably robust performance. Yet…

- Performance is very variable from market to market: there are distinct hot-spots and cold-spots. Performance therefore also varies from brand to brand and from company to company; as do the platforms used and business models that drive them.

- B2B remains significantly stronger than Consumer in most metrics. Yet the gap is closing as Consumer starts to accelerate slowly and as B2B cools down after a strong run.

- The SME sector is still very active, creative and fast-moving. Yet there are growing concerns among the smaller operations about having the resources and knowledge to invest in their long-term futures.

- Just as there is a general shift of focus from pure topline growth to bottom line profitability, so there is a move from volume to value and yields. Much of the financial growth is coming from much more aggressive pricing.

Constant “Rubik’s-Cubing” to adapt to changing circumstances. That means…

- Coming to rational assessments of (1) the value of owned content to the end user and (2) the price that can be charged for that. This will entail some radical re-assessments of the content architecture in terms of the content products and services and how they are packaged, with à la carte standalones versus service bundles being a key decision (which will probably be revised and tweaked constantly).

- Having clear positions on internal culture (which should be relatively stable and consistent), organisation structure (probably in constant flux) and skills…

- Knowing how to reskill the organisation raises a number of questions. Do you really know what capabilities are needed? Do you rent them (outsource), buy them in (recruit new people with new skills) or upskill existing staff?

Sorting out the big issues. The top two remain tech stacks and people.

What should we be doing about all this?

- Understand what works now and why? Refresh what works (this will probably pay the bills for the time being) and replace what does not work.

- Focus and prioritise. Doing too many things at once can undermine quality, consistency and brand image. It can also stretch and confuse staff to breaking point. Be ruthless about what needs to be done as opposed to what would be nice to do.

- Implement swiftly, but competently. Many great strategies flop because the boring task of project management is an afterthought. The wrong people are often in charge of the wrong things. Hasty judgements about external partners and suppliers will come back to bite – with a vengeance.

- Adapt. There are no lasting, “silver bullets”. Today’s good ideas degrade and become tired quickly. Today’s half-good ideas need fine-tuning. Today’s bad ideas need burying quickly, whilst analysing (and remembering!) the lessons learned.

- Just keep going. Confidence, resilience, energy and self-belief are just as critical for companies as for individuals.

The overall picture is that there is a weary acceptance of permacrisis. Some companies are approaching this with positive attack – their priorities sorted and being implemented at speed, resulting in positive growth and robust profits. At the other extreme, some operations are slowly sinking or running out of steam, overwhelmed by the super-abundance of options wherever they look. The answer is the constant twisting of the Rubik’s-cube, with the occasional flip – changing direction and pace in an intense burst. Twisting and flipping through permacrisis.

The full ‘mediafuturesPULSE Q4 2023’ report is available from Wessenden Marketing at a cost of £95. Contact Jim Bilton at Wessenden Marketing: jim@wessenden.com