2023 was all about coming to terms with “Permacrisis”: a weary acceptance of constant and accelerating change. By contrast, things have moved on in 2024. The challenges remain, but many companies are now further progressed with their own strategic plans. Yet there is a real sense of treading water this year: of companies waiting for the “big wave” to come in 2025, on which they will be able to surf into rising turnovers and increasing profits. This might well be a bit of wishful thinking, but there appears to be a real belief in improvements next year.

However, none of this should gloss over the hard choices and challenges ahead, and the fact that the whole industry continues to fragment into very company-specific (and indeed brand-specific) strategies. There are also no illusions about there being any “silver bullets” or that a “one-size-fits all” approach can ever work again.

Some companies are approaching all of this with positive attack — their priorities sorted and being implemented at speed, resulting in positive growth and robust profits. At the other extreme, some operations are slowly sinking or running out of steam, overwhelmed by the super-abundance of options wherever they look. The answer is in the constant twisting of the business model Rubik’s-Cube, with the occasional flip — changing direction and pace in an intense burst. Twisting and flipping whilst waiting for the Big One.

The Big Picture Context

The three main sectors tracked by mediafutures (newspapers, consumer magazines and B2B) are (1) relatively small in themselves in the bigger entertainment and media landscape, (2) show quite distinct financial performance and trends from each other, (3) are fragmenting internally in terms of their business models and vertical niching, at the same time as (4) overlapping increasingly in their activities and platforms, especially the distinction between consumer magazines and B2B.

All this is set against a general economic background, which has seen stagnation rather than dramatic boom-and-bust. Yet this situation is also very varied across business sectors and between consumer cohorts. The UK economy itself is becoming more complex, fragmented and volatile.

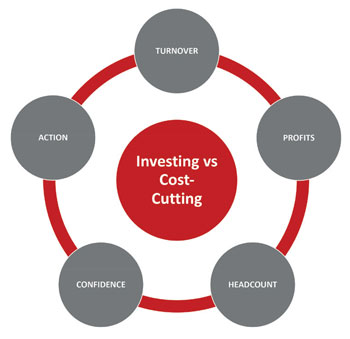

This picture is replicated in the media business itself and has been mapped by mediafutures for some years. The underlying evolution is obviously towards digital media, but legacy activities are not always being replaced by the new platforms. Instead, they often run side-by-side, adapting and mutating, sometimes in surprising ways. This means that business models can vary radically from brand to brand, never mind from company to company. The specific dynamics can also change rapidly through time. Yet a handful of key metrics sit behind every model. This is what we now track more regularly through our new mediafuturesPULSE. The latest wave of fieldwork took place through the summer.

1. Turnover growth

Percentage of companies in growth: 53% now / 69% in 12 months’ time; Average growth rate: +4.2% YoY now / +6.6% in 12 months’ time

Turnover growth has slowed down significantly since 2022, when it was running at +10%. This slowdown continued through 2023 (+3.8%), but has started to strengthen slightly in 2024 (+4.2%) and is predicted to come back strongly in 2025 (+6.6%).

- Consumer versus B2B. There is still a gap between consumer media (+3.6% in 2024) and B2B (+4.8%). Yet this historic gap is closing and will continue to close in 2025, as B2B growth slows and consumer accelerates.

- Company size. Here, the figures are more erratic from company to company, but the overall picture is clear: the ‘majors’ (£50m+ turnover) and ‘large’ (£10-49m) look very sluggish in comparison to the SME sector, with the hottest activity coming from the ‘small’ segment (under £5m).

2. Profits

Percentage of companies in profit: 67% now / 92% in 12 months’ time; Average margin of profitable companies: 9.2% now / 10.9% in 12 months’ time

After a difficult two years, particularly for consumer publishers, profits are beginning to come back, with some optimism about next year. The larger companies may not be showing great turnover growth, but most are leveraging strong and growing profits. The smaller companies show a real range of profit performance, from struggling legacy operations, through successfully transforming companies who are seeing the benefits of their restructures, on to start-ups, who tend to have very volatile financial dynamics.

3. Headcount & productivity

22% of companies increasing staff over next 12 months

Industry headcount dived in pandemic 2020, but then grew strongly in 2022, as reshaped organisations began to staff up again. Yet this was usually from a much lower base than pre-Covid and was led by B2B and by smaller companies. In 2024, total industry headcount is still growing, but this growth has slowed down markedly and has some complex undercurrents and unresolved issues that still need to be sorted.

There is now even more focus than ever before on productivity: the growth of automation and the advent of new AI tools is helping many companies to double-down on this aspect of their operation. Yet this is not yet showing in improved productivity figures across the industry. The topline figure across the whole sample is £136,000 of turnover per full-time employee (FTE). The range of performance remains wide, stretching from £40,000 up to £300,000, with consumer slightly stronger than B2B.

4. Confidence in the financial success of the company

7.1 out of 10 score / 49% more positive than a year ago

With the whole industry being so volatile, and with individual company performance being so varied, it is no surprise that corporate confidence is also very wide-ranging. Yet overall, confidence remains steady and robust, given the volatility of the environment. This “soft” metric is becoming increasingly important, as it reflects the corporate energy to keep going.

5. Implementation of the action plan

67% have clear & active plans in place

The 67% figure is made up of 43% who have clear plans in place, where the strategy has been sold and communicated through the business, plus 24% who still have the internal “buy-in” process to go through. This leaves a vulnerable (and significant) 33%, who are either still working on the plan or who know broadly what they want to do, but do not yet have a structured plan in place.

Balancing the metrics

These five metrics feed into some major judgement calls that every media business is having to make currently about how to juggle these factors.

We asked participants how they were balancing investing in the business (where “investing” stretches across spending on marketing, research, tech stacks, journalism and content creation, staff headcount, staff training, etc) against actively taking cost out. There are three core groups:

- Investors (27%) are pumping more money into the business than the costs they are taking out. Typically, these companies are well on their strategic journey. Most have been through the pain of a major restructure and right-sizing; they are taking a long-term view, which includes an acceptance that there will be a short-term profit hit; and they are confident about the future.

- Balancers (51%) form the largest group. They are prudently funding their investments by taking out cost at the same time.

- Cutters (22%) divide into (1) efficient, productive and lean operations, (2) people right-sizing before investing and (3) those who are simply desperately fighting to survive.

We then asked whether that balance was likely to be different in twelve months’ time. As a sign of the volatility of the whole industry, 41% are preparing to flip into a different approach:

- Positive Flippers (22%) are about to flip into investment.

- Negative Flippers (19%) are preparing for the pain of right-sizing and cost-cutting.

- Steady State (59%) are holding to a consistent strategy.

What does all this mean?

- The uncontrollable tides are more unpredictable than ever. The overarching economic stagnation, volatile confidence levels and rising operating costs are affecting every business. There are media-specific issues such as print and paper prices, volatile social media traffic, disappointing digital advertising volumes and yields, the trend from reading into short-form video, etc. In addition, the impact of AI on media is multi-faceted, a mix of pros and cons, and very unpredictable, with a lurking existential threat behind it all.

- Relatively strong media metrics in testing times. Despite all the stresses and challenges, the industry is showing a remarkably robust performance. However...

- Performance is very variable from market to market. There are distinct hot-spots and cold-spots. Performance also varies from brand to brand and from company to company; as do the platforms used and business models that drive them.

- B2B remains significantly stronger than consumer in most metrics. Yet the gap is closing as consumer starts to accelerate slowly and as B2B cools down after a strong run.

- The SME sector is still very active, creative and fast-moving. Yet there are growing concerns among the smaller operations about having the resources and knowledge to invest in their long-term futures. Meanwhile, the ‘majors’ are getting their act together more, certainly in terms of profitability.

- The journey from volume to value continues. Just as there is a general, company shift of focus from pure topline growth to bottom-line profitability, so there is a move at brand level from volume to value and yields. Linked to that, much of the financial growth currently is coming from more aggressive pricing.

- Constant “Rubik’s-Cubing” to keep adapting. That means coming to rational assessments of (1) the value of owned content to the end-user and (2) the price that can be charged for that. This will entail some radical re-assessments of the content architecture in terms of the content products and services and how they are packaged, with à la carte standalones versus service bundles being a key decision (which will probably be revised and tweaked constantly). Also, having clear positions on internal culture (which must and should be relatively stable and consistent), organisation structure (probably in constant flux) and skills. Knowing how to reskill the organisation raises a number of questions. Which capabilities are really needed? Do you rent them in (outsource), buy them in (recruit new people with new skills) or upskill existing staff?

So, there are some big issues that still need sorting. And the top two remain tech stacks and people.

mediafutures is an ongoing benchmarking survey of the industry undertaken by Wessenden Marketing in partnership with InPublishing. Now in its 16th year, it maps the key drivers, metrics and issues that are transforming the shape and direction of the whole media business. mediafuturesPULSE is a new, more regular tracking survey of key industry performance metrics.

This article was first published in InPublishing magazine. If you would like to be added to the free mailing list to receive the magazine, please register here.