According to Trinity Mirror:

Key Highlights:

* Strong growth in adjusted operating profit and adjusted earnings per share

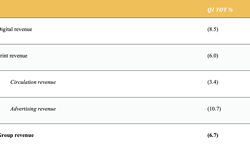

Strong growth in adjusted operating profit of 25.5% and adjusted earnings per share of 12.4% driven by the benefits of the acquisition of Local World and continued tight management of the cost base with structural (including synergy) cost savings of £25 million, £10 million ahead of target. Group revenue increased by 20.3% to £713.0 million with like for like revenue falling by 8.0%.

* Continued growth in digital audience and revenue

Continued growth in digital audience with average monthly page views on a like for like basis growing by 15.4% to 636.1 million. Like for like publishing digital revenue grew by 12.8% to £78.5 million with digital display and transactional revenue growing by 24.7% partially offset by digital classified revenue falling by 11.3%.

* Local World integration ahead of expectations

Excellent progress on integrating Local World delivering £10 million of synergy savings in 2016. Forecast annualised savings of £15 million in 2017 which is £3 million ahead of the target announced at the time of the acquisition in 2015.

* Pension deficit increase

The IAS19 pension deficit increased by £160.8 million to £466.0 million (£385.1 million net of deferred tax) driven by a fall in long term interest rates and higher inflation expectations. The Group paid £40.7 million into the defined benefit pension schemes during 2016.

* Historical legal issues

As previously announced, we increased the provision for dealing with historical legal issues by £11.5 million.

* Strong cash generation and committed long term financing improves financial flexibility

Adjusted EBITDA of £159.7 million and strong net cash inflows resulted in net debt reducing by £62.4 million to £30.5 million. We have financial flexibility with a new amortising £110 million bank facility which is committed until December 2021.

* Share buyback progressing and 6.3% increase in final dividend to 3.35 pence per share

The Group acquired 2.5 million shares for £2.3 million under the £10 million share repurchase programme announced in August 2016. A final dividend of 3.35 pence per share, an increase of 6.3% per share, is proposed bringing the total dividend for 2016 to 5.45 pence per share, an increase of 5.8% per share. We remain committed to our progressive dividend policy, and the Board expects dividends to increase by at least 5% per annum.

* Refreshed strategy and outlook

We have refreshed our strategy and have adopted new financial KPIs to ensure an even closer alignment between our strategic initiatives and their financial outcomes. Our four key areas of strategic focus are to grow digital audience and revenue, to build new diversified revenue streams, to protect our strong print brands and to seek out strategic opportunities that drive value. The Board remains confident that our strategy will meet our objective to deliver sustainable growth in revenue, profit and cash flow over the medium term.

Commenting on the annual results for 2016, Simon Fox, Chief Executive, Trinity Mirror plc, said: "We have delivered a strong financial performance in the year despite the challenging environment we face. I am particularly pleased with the progress we have made in growing our digital audience and revenue, and with the work we have done this year to develop and refine our strategic priorities for the year ahead."